Property investment is one of the most popular ways to invest your money. With property investment, you buy a property and then rent it out to tenants who pay you a monthly rental income. There are many different types of property investments, and here we will go over the basics of each type.

The first type is called a buy-to-let investment. This is where you purchase an investment property, rent it out and collect the monthly rental income. The second type is called an equity release mortgage, which is where you borrow money against your home to finance an investment property purchase. The third type of property investment is called a commercial or office building leasehold interest, where you are buying commercial or office buildings from their owners as tenants with long leases on them for a fixed rental income each month for many years.

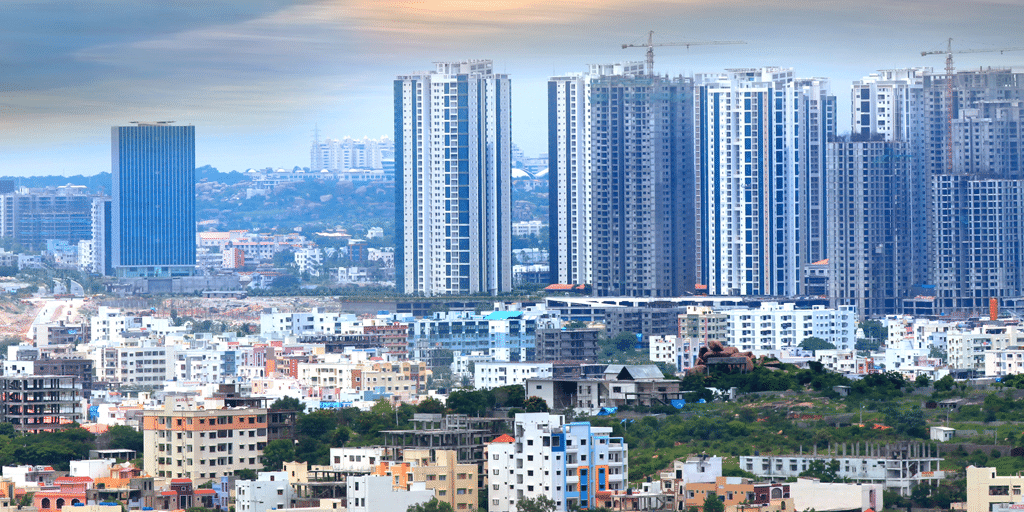

The most popular cities for property investment in India are Delhi, Mumbai and Bangalore.

– Delhi is the capital of India and the most populous city in India. It is also one of the oldest cities in the world.

– Mumbai is a commercial capital with a large number of millionaires, billionaires and top companies in India.

– Bangalore is a major IT hub with a technology startup culture and one of the best educational institutions in Asia.

Buying a house or a property in India is not as straightforward as it seems. The legal requirements and steps are not only complicated but also vary from state to state.

Before buying a property in India, one has to take care of the following:

– The stamp duty

– Registration of the property

– Getting approval from the concerned civic authority

– Getting approval from the bank for a loan

Local metrics influence property investment. In India, for example, the market for real estate is entirely different from the market in the United States. The states in India each have their own distinct property markets. Moreover, even though Gurgaon and Sonipat are similarly situated in Haryana, they are different real estate markets.

Real estate is probably not the best investment for someone looking to make quick bucks. Real estate prices appreciate over time. When you purchase a plot in an upcoming locality, the sale may not offer you tremendous gains for several years. The economy does not change quickly in real estate.

In India, commercial real estate has been largely unregulated, allowing investors to save on taxes. However, several rules and regulations have been implemented in order to prevent real estate investment from being misused. A real estate investor who wants to build a fortune must be familiar with all these laws in order to build a strong foundation. In addition to the RERA Act, the GST Act and the Benami Properties Act are among these laws.

A beginner who wants to succeed in real estate may find that research and development are not always sufficient. An investor who is new to investing is better off with advice because of the legal and financial complexities involved. As important as understanding the basics of real estate investment in India is getting the assistance of lawyers, chartered accountants, and property brokers. A book can only teach you so much about any subject; your knowledge comes from your interaction with experts.

In recent years, new instruments, such as real estate investment trusts and infrastructure investment trusts, have been introduced with low price points. Contrary to stocks and fixed deposits, however, real estate does not allow you to start with small amounts of money. It takes a significant amount of money to invest in real estate. The initial capital is largely determined by local factors, which makes quoting a specific figure difficult. In general, Rs. 10 lakhs or more would be the minimum amount to invest in a house.

Investing in real estate generates income that is subject to tax, just as any other income is. Investment gains may be reduced by taxes. There are several laws that help lower tax obligations. Learn how to reduce your income tax burden.

Stamp duty and registration charges on property purchases are a major source of revenue for states. Investing in property becomes significantly more expensive as a result. Take these into account when determining how much to invest.

The cheapest property in India is a difficult question to answer. This is because the answer would depend on what you are looking for. If you want a house, then it would be difficult to find one for less than 2 lakhs. But if you want an apartment, then there are many options that cost less than 10 lakhs.

Property in India can be defined as any kind of real estate that can be bought from a developer or owner and sold to another person at a later date for a profit. A property could also refer to the land on which the structure is built or the building itself. Some people might also use this term to refer to their home or residence, but this is not always the case and depends on where they live and what they mean when they say “property.”

The first thing you want to do when you find a project or builder is to look at the ratings and reviews. These are important because they tell you how other people feel about the project or builder. You should also check out their website and see if there is any information about their pricing.

If you like what you see, then it is time for a quick chat with them on Skype or another video chat service. If that goes well, then it’s time to make your decision!

Investing in real estate is a complicated process. There are many factors that go into the decision to buy property, including the location, type of property, and cost of the property. It is important for investors to understand all of these factors before making any decisions.

There are many costs involved when investing in real estate. The most obvious cost is the purchase price, but there are also other costs that can add up quickly without proper consideration. These include closing costs, insurance costs, association dues and taxes on the property if it is not your primary residence. When looking at these additional expenses, it becomes clear that investing in property can be a costly endeavour, and careful consideration should be given to all aspects before making an investment decision.

Company Address

Pearl Lemon Properties

34-35 Strand, Charing Cross, London WC2N 5HY

Contact Detail

UK: +442071833436

US: +16502784421

© All Rights Reserved | Company Number: 10411490 | VAT Number: 252 7124 23