You know the old saying about real estate.

“It’s all about location, location, location.”

Which is true. Location is extremely important in real estate.

But, you know what else is important in real estate investments?

Strategy, strategy, strategy! (property investment strategies that is)

You can get a property in some of the best locations, but if you have the wrong strategy, you might not reap its full potential.

Implementing the right investment strategy on the other hand can help you get the most out of your property.

There are tons of different property investment strategies out there to make money off of your property investment.

This blog is going to focus on some of the best strategies out there for long term property investments.

Figure Out What You Want

Before determining what strategy you want to implement, you should first figure out what you want out of your long term investment strategies.

Because each strategy will have different outcomes. And there may be some that simply aren’t feasible for you right now.

When debating which strategy to use, ask yourself:

- How much am I willing to invest?

- How much time am I willing to invest?

- What do I want out of this?

- Am I looking for short term cash flow or a long term payout? Or both?

- How much effort do I want to put in?

Long vs Short Term Investment

The difference between long and short term real estate investments is pretty self-explanatory.

One takes place over a long period of time, while the other takes place over a short period of time.

Long term investment strategies last for years to either profit off of property value appreciation, from renting your property out or both.

Short term investments usually involve improving then reselling the property as quickly as possible to turn a profit. I.e. your typical fix and flip

If you’ve ever seen even a little HGTV, you know exactly what this is.

Again, this blog is going to focus on strategies for long term investments.

But it will be worth taking a look at the advantages and disadvantages of both long and short term investments to help see which one is better for you.

Advantages: Long Term

Effort

If you want to take a super passive role in your investment, then long term is the way to go.

After purchasing a property, you can hand it off to professional property management services and hire cleaning and maintenance staff.

On the other hand, if you want to take a more active role, then by all means you go for it! It’s your property after all.

Equity

With a long term investment, you could build equity over time.

Equity is how much you could make on your property if you were to sell after paying off the mortgage.

In other words, it is “the difference between how much your home is worth and how much you owe on your mortgage.”

So, if you have a property that is worth $300,000, and you owe $200,000 on the mortgage, then your equity is $100,000. This is assuming you sell at the fair market value.

Therefore the more equity you have, the bigger the profit you can turn later down the road.

In simple terms, you want more equity.

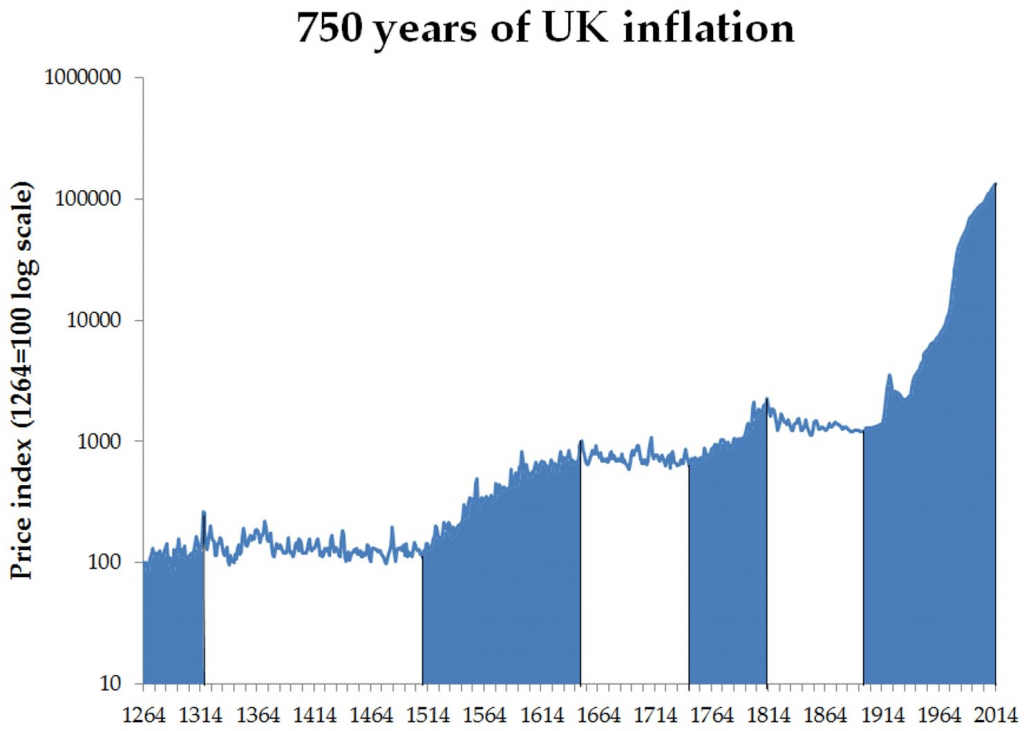

Hedge Against Inflation

An inflation hedge is an investment that is supposed to protect the investor against the decreased purchasing power of a currency that results from its loss of value because of

things like inflation.

Traditionally, real estate is a pretty good hedge against inflation, because as inflation rises, so do property values and the amount you can charge for rent.

Ever wonder why each year your rent increases? Well, this is why.

Super frustrating I’m sure, but now you get to be on the other end of it!

Tax Benefits

Long-term capital gains, which are properties held a year and one day or more, are taxed more favorably, ranging from 0% to 20% depending on your tax bracket.

Short term capital gains, properties held for less than a year, are typically taxed at a range of 10%-37%.

There are also tons of tax-deductible expenses if you go the route of renting out your property, including:

- Property tax.

- Property insurance.

- Mortgage interest.

- Property management fees.

- Property repairs, capital improvements, or ongoing maintenance.

- Advertising expenses

Disadvantages: Long Term

Vacancies

Even if you are using your long term investment as a rental property, there is a good chance that there will be vacancies at times.

Not only are these periods where you won’t be making any money off of your property, but there may be expenses you have to pay out of pocket.To counteract this, be very proactive in finding tenants, and be sure to market your property.

Poor Tenants

If you rent your property out, there is the risk that tenants can do more harm than good.

Whether that be damaging your property, unexpected vacancies, or not paying rent.

To avoid this, be sure to screen your potential tenants and run the proper background checks.

Depreciation

One of the strategies with long term investing involves taking advantage of appreciation, which is when the value of your property increases over time (more on this later).

However, it is possible that your property depreciates, or loses value.

So, when figuring out what property to purchase, be sure to look at areas that are on the rise, as well as the trends that are going on with the type of property you are purchasing (house, apartment, condo, etc.)

Time

There is a reason it is called a long term investment. It takes TIME.

Because of this, it may be a while before you see a profit.

If you can stick it out, it will be worth it. Long term investments are typically pretty safe and often successful.

But if you’re going to go for one, be sure that you aren’t in immediate need of cash, and are ready to stick it out for the long haul.

Advantages: Short Term

It’s Quick

With short term real estate strategies, you will get a much quicker return on your investment, which could make this one of the best property investments.

If you do it right, it could take less than a year.

That’s because, with short term investments, you’re not relying on appreciation, rather you are usually improving the physical space yourself.

It’s In Your Hands

With short term strategies, you aren’t relying on the economy, the stock market, or property values. In other words, things you can’t control.

With short term strategies, you have more control over how much you will get back.

If you put in the effort, do a good job, and are proactive in finding buyers, you are more likely to yield a better result.

Disadvantages: Short Term

Risky

There is a lot more risk with short term strategies than long.

Sure, if the stock market crashes, you could be screwed, (just look at the 2008 recession in the US). So there is some risk involved in long term investments as well.

But in general, long term investments are safer, as property values are usually increasing.

With short term strategies though, there are a lot of unknowns.

There are often unexpected costs and issues with the house, and you don’t know how long it will take to find a buyer willing to pay enough for you to make a profit, which could lead to an increase in holding costs.

In general, there is a greater risk that you will lose money on a short term investment.

High Effort, High Stress

Short term strategies take a TON of effort.

You have to find the right property, renovate it, market it, finally sell it.

This all takes a boatload of work.

Your options would be to do it yourself or outsource it, which would increase the amount of money you’re spending which could eat away at your profit.

And with that comes a ton of stress.

Also, the goal with short term strategies is to sell your property as quickly as possible, because the longer you own it, the more you will be paying in holding costs and taxes.

So it can get super stressful trying to get the place fixed up and finding buyers in time to turn a profit.

The Best Long Term Strategies

Alright so if after all of that, it’s time to ask yourself,

“Is long term property investment the right move for me?”

If yes, then great! Congratulations on making a life-altering decision!

Now, the next step is determining how you want to go about your long term investment.

Like I said earlier, there are tons of strategies you can implement. Here are some of the best out there.

Long Term Rental

This strategy involves buying a property and renting it out to people for long periods of time, usually a year or more.

This is one of the more traditional long term investment strategies.

With long term rentals, you bring in a regular cash flow that you use to help pay off the mortgage, and eventually, if you keep the property, make a profit.

Probably the biggest advantage of renting long term is how little effort it is compared to other strategies.

If you hire a property management service, you practically don’t have to do anything besides meet potential tenants and sign the lease.

There may be some rare occasions where your presence is needed, but other than that, your job is done after the pen hits the paper.

You also don’t need a ton of education, and this doesn’t have to be your main job. Essentially it is your “side hustle.”

And, as mentioned earlier, there are tons of tax benefits to renting.

Short Term Rentals

Short term rentals are like long term rentals, but shorter. I know, not the most creative name.

These rentals are Airbnb style, where one or more persons will stay in your property from a range of a couple of days to a few months.

There are not long term lease agreements, and it is usually charged per night.

Because of this, short term rentals have the potential to bring in more money, as it is standard to charge more for shorter stays.

The average rent per month in London is £1,665.

The average cost per night for an Airbnb in London is £125. Multiply that over the course of a 30 day month and you get £3,750 a month.

If my math is right, and it always is, on average you would make £2,085 more per month with the short term rental option.

There are some cons to this though.

Short term rentals take a lot more effort.

For starters, you will have to completely furnish the place, as well as include wifi and cable or streaming services.

And the rapid turnover in renters means you will constantly be cleaning, stocking, and maintaining your property.

You could outsource this all to a cleaning service, but that would take away from your revenue.

The other option is to include those costs to the renting charge, but you risk potentially driving away potential renters because the price is too high.

The plus side of this though is that you will likely keep your place better maintained from the constant cleaning.

You will also be more likely to notice issues with your place, whereas you may not see problems with your long term rentals until your tenants move out.

You will also need to be very proactive in filling vacancies and with your marketing efforts.

Because yeah, hypothetically if you had your place booked every night, you would make more money than with long term rentals. But the challenge comes with keeping your place filled.

Long term rentals come with the guarantee that your place will be filled for months or years.

Oh and don’t forget the increased risk of damages.

The more guests you have, the higher the chance you may get a few bad apples damaging your place, usually coming in the form of parties.

Just like with your long term rentals, it will be helpful here to screen your potential renters and lay out some ground rules.

Buy And Hold

Again, not a super creative title here.

This strategy involves purchasing a property and holding onto it long term with the intention of eventually selling it. For some this is the most suiting best property investment strategy.

Or “letting go,” if you want to stick to the metaphor.

Buy and hold seeks to take advantage of appreciation, meaning that the value of the property will go up while you own it, so you can sell it for a higher price than you bought it for to make a profit.

Something to consider while implementing this strategy is to rent it out while you are holding onto the property. Otherwise, the space is just going to waste right?

Doing so will give you some short term cash flow that can help you pay the mortgage and cover expenses, while also knowing you’re going to get some long term gains.

In other words, to quote Hannah Montana, it’s the best of both worlds!

Before starting the buy and hold process, it is super important that you do a lot of research, especially because appreciation plays such a big factor.

If you choose to rent, you should calculate the potential income of doing so and how that stacks up against payments on the mortgage, interest, taxes, fees and maintenance.

You’ll want to take into account the potential profit of selling the property in the future and the cost of taking out loans and other financings as well.

You should also research where you want to invest (see: location, location, location!).

Specifically, look for areas that have a lot of potential in terms of property appreciation and a promising renting market.

Some really good markets to look at right now in the UK are:

- Birmingham

- Liverpool

- Manchester

- Leicester

- Nottingham

- Sheffield

- Oxford

Some Cheaper Options

Ok, maybe you’re reading this and thinking,

“This sounds great and all, but I don’t have the money to buy a property.”

Well, you’re in luck!

Because you can still get in on some real estate investment action with these cheaper options.

REITs

Real Estate Investment Trusts (REIT) are companies that own, operate, or finance real estate.

People can invest in REITs, and earn a percentage of the income REITs generate by owning property.

To invest in a REIT, you can buy shares through a broker. These shares can be publicly traded on security exchanges.

There are a few types of REITs:

- Equity REIT– companies that own income-generating properties such as apartments, shopping centers, etc. Shareholders earn portions of the revenue they get from easing their property.

- Mortgage REIT– help finance income-generating real estate by buying mortgages and mortgage-backed securities. Shareholders earn a portion of the revenue generated by the interest on the mortgages.

- Hybrid REIT– engages in both equity and mortgage-based REITs

REITs can also be classified based off of how they are traded as well:

- Publicly traded REIT– traded publicly on exchanges

- Public non-traded REIT– registered with the SEC but not available on an exchange. Can be purchased through a broker who participates in public non-trade offerings

- Private REIT– not traded on exchanges, nor registered with the SEC. Typically only sold to institutional investors

Essentially, investing in REITs is the real estate version of investing in stocks.

This makes them perfect for people wanting to get in on the real estate game without spending thousands or millions.

How many people do you know who are invested in Apple? I’m guessing they were never quite Steve Jobs level rich.

REIT investments can be for as little as $1,000, which is super cheap compared to buying an entire apartment complex.

They also involve almost no effort, even less than long term rentals.

All you have to do is buy a share and then… well, that’s it.

You’re investing in a company, so you let them do the work, while you bring in a regular income from them. Your share can also be sold just as effortlessly, making this a very liquid option.

There are a few downsides to REITs though, one being their sensitivity to interest fluctuations.

This means you will see a lot of ups and downs with the value of your REIT.

This isn’t something to be super concerned about or to make you trigger happy when selling. But you should definitely be aware of it and be ready to stay invested for the long haul.

REITs also often do not have very diversified portfolios, usually specializing in a specific property type. That means you have to take into account the risks that come with investing in said property type.

If you want to play it safer, it would be worth finding REITs with a more diverse portfolio, that way if one type has a downward trend, you won’t be affected as much.

They also don’t offer a ton in terms of capital appreciation, and dividends are taxed as ordinary income (although REITs pay zero corporate tax).

At this point, if you’re thinking about investing in a REIT, great!

To get you started, here is a list of a ton of REITs located in the UK:

- AEW UK REIT

- Assura

- Big Yellow Group

- British Land Company

- Broadgate REIT

- Capital & Regional

- Custodian REIT

- Derwent London

- Ediston Property Investments Company

- Empiric Student Property

- F&C Real Estate Investments

- GCP Student Living

- Glenstone Property Group

- Great Portland Estates

- Ground Rents Income Fund

- Hammerson

Hansteen Holdings - Highcroft Investments

- Intu Properties

- K&C REIT

- Land Securities

- The Local Shopping REIT

- LondonMetric Property

- McKay Securities

- Mill Residential REIT

- Mucklow (A & J) Group

- NewRiver Retail

- Primary Health Properties

- Real Estate Investors

- Redefine International

- SEGRO

- Safestore Holdings

- Secure Income REIT

- Schroder Real Estate Investment Trust

- Shaftesbury

- Standard Life Investments Property Income Trusts

- Target Healthcare REIT

- Town Centre Securities

- Tritax Big Box REIT

- Workspace Group

Crowdfunding

Real estate crowdfunding is very similar to REITs, where a company pools together money from investors to use for their business, and investors then get to share in the profits.

There are a couple of key differences, however.

One is that real estate crowdfunding takes place primarily online and through social media.

It is also cheaper to invest in crowdfunding. Typically, the minimum is around £1,000 but can be as little as £100 depending on the platform.

This allows for people to invest in real estate who don’t have the money to buy properties themselves or get involved with REITs.

It is also great for smaller companies and startups to access capital and resources they normally wouldn’t be able to.

Because it is often startups who are new and inexperienced companies that use crowdfunding, there is a much greater risk with this strategy than the other ones mentioned above.

That is why despite the fact that it is easier to get involved in crowdfunding, there are some regulations.

UK Regulations

There are essentially four types of crowdfunding according to the FCA:

- Loan-based crowdfunding: consumers lend money in return for interest payments and a repayment of capital over time

- Investment-based crowdfunding: consumers invest directly or indirectly in new or established businesses by buying investments such as shares or debentures

- Donation-based crowdfunding: people give money to enterprises or organizations they want to support

- Pre-payment or rewards-based crowdfunding: people give money in return for a reward, service or product (such as concert tickets, an innovative product, or a computer game)

The latter two, Donation-based and Pre-payment/rewards, are not regulated.

However, both Loan-based and Investment-based are regulated by the FCA.

Now there are tons of rules that the FCA has about crowdfunding, most of which are in place to protect the investor.

You can find those here, in a 90+ page behemoth of a document which is way too long to sum up in one blog post.

But, here are the qualifications you need to know in order to invest in real estate crowdfunding.

Platforms may work only with clients who meet certain criteria, including:

- High net worth or sophisticated investors such as VCs and high-net-worth individuals.

- Clients who take regulated advice.

- Clients who can confirm that they will invest less than 10% of their net assets in certain security.

US Regulations

In the United States, non-accredited investors can invest in crowdfunding.

An accredited investor is someone who has a net worth of at least $1,000,000 or has earned at least $200,000 for the last two years.

The SEC though has put limits on investments to protect investors from the risk that comes with crowdfunding:

“If either your annual income or your net worth is less than $107,000, then during any 12-month period, you can invest up to the greater of either $2,200 or 5% of the lesser of your annual income or net worth.

If both your annual income and your net worth are equal to or more than $107,000, then during any 12-month period, you can invest up to 10% of annual income or net worth, whichever is lesser, but not to exceed $107,000.” – Per the SEC.

Where To Find Real Estate Crowdfunding

At this point, if you’re thinking that real estate crowdfunding is the way to go, then great!

Here are some of the best platforms for real estate crowdfunding in the UK to start your search:

- Property Partner

- Proplend

- Sourced Capital

- Property Moose

- Estate Guru

- Crowd Property

- Crowd Estate

- Raizers

- Bulk Estate

- Nordstreet

- Rendity

- Kuflink

- Blend

Need Help?

Need help with your long term property investment strategy? Or just looking to get started with your first property investment?

Then contact Pearl Lemon Properties today!

FAQs

What are the 4 investment strategies?

Here are the 4 common types of property investment strategies.

- Value Investing

- Growth Investing

- Momentum Investing

- Dollar Cost Averaging

What are some real estate investment strategies?

There is not one “best property investment strategy” rather there are multiple strategies that investors prefer. There is the 50% rule, 70% rule, and 5% rule

What is a property investment strategy?

A long-term property investment strategy lays a clear path to your goal of making cashflow and capital growth from properties.

How do I set up an investment strategy?

For property investment, it is important to do some research on the location you are looking to invest in. If you don’t know where to start the UK is one of the best places for beginners. From there don’t be afraid to ask for help.

What is the best strategy for a beginner investor?

The best strategy for beginners is to look for low-risk properties and high returns. A flat is the most popular property to invest in but check out this guide for beginners.