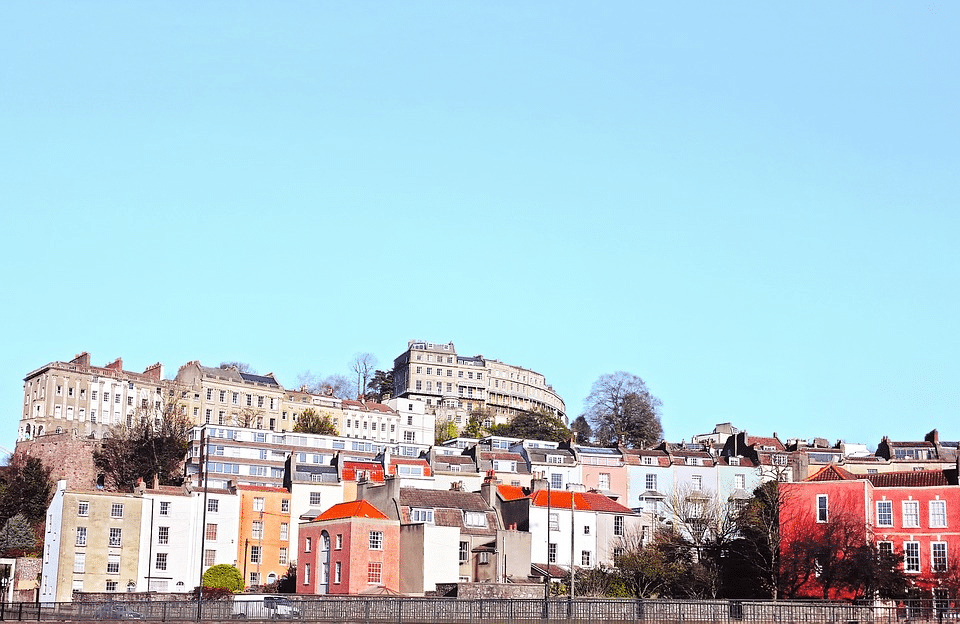

Source: Pixabay

Finding a new house is always a challenging affair. From lots of competition to highly high house prices, there are so many different issues you can run into when buying a home. And with house prices set to continue rising in the future, finding the perfect house in your budget might become even more complex.

House-hunting shouldn’t be a chore! It should be a time where you get to explore new areas in the UK and the rest of the world. Moving house even allows you to relocate to a whole new city or even country!

There are lots of options to buy a house that many people don’t know exist. This article will introduce you to alternative ways of buying a house that can save you money and give you a home that you love.

We’ll also give you some things you need to think about when buying your new home that can affect the price of the house.

Prices of houses aren’t like prices of goods you buy at a shop. Many different things can affect the house price, so you need to research to ensure you’re not getting ripped off.

The most obvious factor of the price is the size of the house you’re looking for. As the number of rooms goes up, usually the price of the house goes up as well. This makes sense as you get a bit more ‘house’ for the extra money.

So if you’re looking for cheap houses for sale, you need to know what you need in your house. Different sizes of houses fit different people- there’s no point buying a 6-bedroom house if you’re living by yourself!

But if you’re buying your house to house a family, you’ll probably need more rooms than people living individually. Don’t worry, because this doesn’t mean you won’t be able to find cheap houses for sale.

The next factor in house prices is the location of the houses- this is an essential part of house prices. House prices vary a lot depending on the location of the house.

Average prices of houses are very different across the UK. In northern areas of the UK, house prices are traditionally lower than in the south of the UK. In some areas of London, average house prices are over £500,000 compared to £200,000 in areas of Manchester.

This is a huge factor that can be more useful than the size of the house because a 5-bedroom house in Manchester could be the same price or cheaper than a studio flat in Westminister in London!

Therefore, you need to think about where you want to live when buying a house. Houses in some areas of the UK are more affordable than others.

If you’re moving from London to a northern area of the UK, you could save lots of money on deposits and mortgage payments because of the cheaper housing.

Source: Pixabay

There are many different methods of buying a house you love without blowing your budget.

One example is renovating a house. If you look on property websites, usually, the cheapest houses need some work done on them. Likely, the cost of the house plus the cost of the work done will be cheaper than buying a standard house in the same area.

Buying houses needing renovation offers you a lower price and allows you to design a house that works for you. Instead of having to compromise with the design, you get to design the house yourself while renovating.

Buying a house in need of some TLC can come with risks. Make sure you’re taking on a project that you can handle and finish in time for the deadline you set.

An underrated method of buying houses is using auction houses. Some people may see this as old-fashioned, but usually, you can find a house and buy it for a lower price than similar houses in the same area.

Auction houses offer faster sales for the house-sellers and offer you a great variety of houses at bargain prices. If you’re looking to use an auction to buy your house, make sure you local auction houses in the area you’re searching for your house.

Auction houses will provide you with helpful information about houses that are about to go on auction.

Company Address

Pearl Lemon Properties

34-35 Strand, Charing Cross, London WC2N 5HY

Contact Detail

UK: +442071833436

US: +16502784421

© All Rights Reserved | Company Number: 10411490 | VAT Number: 252 7124 23