Introduction

In 2024, the European commercial property market presents a complex yet rewarding landscape, marked by evolving trends, economic shifts, and new investment frontiers. My path in property investment, starting from humble beginnings in West London to exploring the vast opportunities across Europe, has been driven by a keen eye for untapped potential and strategic investments.

This experience has honed my ability to spot value where others may not, particularly in challenging markets. Today, I aim to share strategic insights with fellow European commercial property investors, offering guidance through this dynamic market to uncover promising ventures and navigate potential hurdles.

Understanding the 2024 European Commercial Property Landscape

In 2024, the European commercial property landscape is shaping up to be a nuanced and evolving market. Key insights from Knight Frank suggest that despite a challenging financial context leading to potential refinancing needs, particularly for over-leveraged developers, the market is expected to see optimisations in portfolios with cash-rich buyers remaining active. The demand for office spaces and logistics appears healthy, with significant transactions in the Brussels office market driven by large moves by the EU and a continued boost in the logistics market from big box deals .

PwC’s report highlights a cautious optimism among real estate professionals, with a focus on niche operational asset classes that benefit from global megatrends such as decarbonisation, information technology, demographics, and urbanisation. There’s a growing emphasis on the importance of ESG, with many in the industry now recognising the value it adds. The report suggests a shift towards retrofitting or repurposing buildings as a method to secure high-quality, prime products.

Savills analysis adds to this by noting the structural shift towards stronger demand in prime logistics markets, driven by robust rental growth and eCommerce tailwinds. The report also identifies prime CBD office stock and multifamily properties as core investment picks, with an increasing interest in grocery stores and retail parks. For value-add and opportunistic investors, there’s potential in refurbishing older office stock, investing in modern logistics assets, and focusing on life sciences and data centres.

These insights suggest a complex market where strategic investment decisions, aligned with broader economic and societal trends, could yield significant opportunities. Navigating this landscape requires a keen understanding of market dynamics, the impact of geopolitical events, and a strong commitment to ESG principles.

Investment Strategies for Success

Leveraging Data and Technology

In the dynamic realm of property investment, embracing data analytics and advanced technology has been pivotal. For instance, my venture into using sophisticated algorithms to evaluate market trends and property valuations significantly minimised risks and unearthed valuable opportunities, even in overlooked segments. One memorable success was identifying a high-potential off-plan development through predictive analytics, leading to a lucrative acquisition before public listing.

Tips for Investors: Utilise data analytics tools for real-time market insights and predictive analysis. Platforms that offer comprehensive property data and trend forecasting can be game-changers in making informed decisions.

Building a Network of Trust

The essence of successful property investment often lies in the strength of one’s professional network. My journey has been enriched by collaborations with sourcing companies, real estate experts, and local partners, providing me with insider knowledge and opportunities. A notable triumph was securing a prime residential property, sight unseen, based on the trusted recommendations of my network, illustrating the power of well-placed trust and expert insights.

Personal Anecdotes: Cultivate relationships with industry professionals who can offer nuanced market insights and access to pre-market deals. Attend industry events and engage in real estate forums to expand your network.

Diversifying Your Portfolio

Diversification across various commercial properties and European regions has shielded my investments from market volatility. By spreading interests across office spaces, retail, and warehouses, and tapping into different European markets, I’ve managed to not only mitigate risks but also capitalise on unique market conditions in various locales.

Portfolio Diversification Insights: Consider investments in diverse property types and geographical locations. Evaluating emerging markets or sectors with growth potential, such as green buildings or tech hubs, can provide a hedge against downturns in traditional markets.

In summary, blending cutting-edge technology with a robust network and a diversified portfolio forms the cornerstone of successful property investment. These strategies have been instrumental in navigating the complexities of the market, enabling strategic decisions that drive substantial returns.

Overcoming Challenges: My Insights

Navigating Market Volatility

As a European commercial property investor, market fluctuations have posed significant challenges. During periods of uncertainty, I’ve found that diversifying my portfolio across various property types and geographical locations mitigates risk. Additionally, staying informed about market trends through reliable research has been crucial for making timely decisions.

Adapting to Regulatory Changes

Regulatory changes can impact investment strategies significantly. My approach has been to stay ahead through continuous learning and adapting investment criteria to comply with new regulations. Building strong relationships with legal advisors specialises in real estate has ensured that my investments remain viable and compliant.

Emphasising Adaptability and Informed Decision-Making

Facing these challenges, adaptability and informed decision-making have been my guiding principles. By embracing flexibility in my investment strategy and relying on comprehensive market analysis, I’ve navigated through complexities. This approach has not only helped in overcoming hurdles but also in identifying unique opportunities amidst challenges.

The Future of European Commercial Property Investment

Emerging Investment Hotspots and Growth Sectors

The European commercial property market is poised for transformation, with sustainability and technology driving growth. Emerging hotspots include cities with strong tech industries and green initiatives. Additionally, the logistics sector, particularly in areas close to major urban centres, is expected to flourish due to the e-commerce boom. Residential properties in cities offering quality of life and remote working opportunities will also see increased demand.

Adapting Investment Strategies for Future Success

To stay ahead in the evolving landscape, I plan to integrate more technology and sustainability criteria into my investment decisions. Focusing on properties that offer energy efficiency and are well-positioned to benefit from technological advancements will be key. I’ll also expand my network to include experts in green building and tech innovation, ensuring my portfolio is resilient and aligned with future trends. This forward-thinking approach will allow me to capitalise on new opportunities and navigate the challenges of tomorrow’s market.

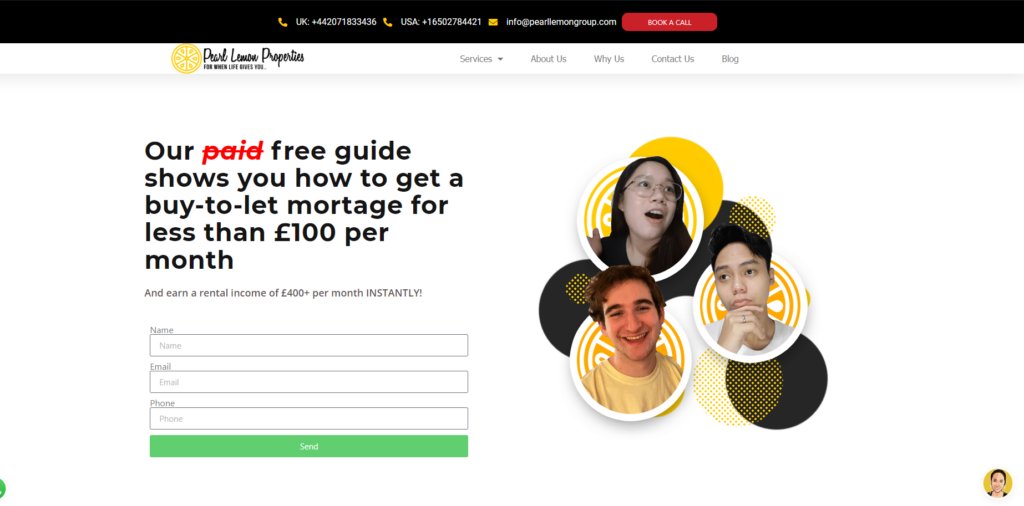

How Pearl Lemon Properties Can Guide You

Aligning Our Approach

At Pearl Lemon Properties, our team’s approach is intricately aligned with the insights shared. We are dedicated to utilising market research, cutting-edge technology, and our extensive network to pinpoint the most lucrative investment opportunities for our clients.

Our Commitment

We commit to providing our clients with access to premier investment options. By leveraging our deep industry connections and technological resources, we ensure every investment is positioned for optimal growth and resilience in the ever-changing market landscape.

Invitation for Personalised Strategy Discussions

I invite you to reach out for tailored investment strategy discussions. Discover how our services can enhance your investment portfolio and provide you with the insights needed for success in the European commercial property market.