Introduction

In 2025, the European luxury real estate market has demonstrated remarkable resilience, becoming a beacon for discerning investors worldwide. My journey into Turin mansion investments epitomises this trend, blending my zeal for exclusive properties with a strategic approach to wealth growth. Europe’s luxury homes, with their rich history and unparalleled elegance, offer a unique investment opportunity. This market’s steadfastness amid economic uncertainties not only intrigues me but also aligns with my ambition to expand my portfolio with assets that promise both prestige and long-term value.

The Allure of European Luxury Homes

Historical and Architectural Magnificence

European luxury properties stand as testaments to the continent’s rich historical tapestry and architectural innovation. The unique charm of these estates, often rooted in centuries-old craftsmanship and design, offers an unparalleled living experience. My foray into investing in such properties was driven by the allure of their distinctive character, which merges elegance with historical significance.

Strategic Enclaves of Luxury

Location plays a pivotal role in the desirability of luxury homes across Europe. From the serene landscapes of the French Riviera to the bustling, cultured streets of London, these properties are strategically situated in environs that offer not just exclusivity but also accessibility to the finest amenities. This strategic placement enhances their investment value significantly.

Emotional and Financial Rewards

Investing in European luxury properties has yielded profound emotional satisfaction along with financial gains. The pride of ownership in a piece of Europe’s heritage is immensely fulfilling. Financially, these investments have proven to be astute, appreciating over time while offering robust rental yields. My journey into the realm of luxury property investment in Europe has been both emotionally rewarding and financially prudent, affirming my belief in the enduring appeal of these magnificent homes.

Understanding the Market Dynamics

The 2025 European luxury real estate landscape is navigating through a complex environment, defined by ongoing geopolitical tensions, inflationary pressures, and evolving ESG (Environmental, Social, and Governance) requirements. Despite these challenges, there’s cautious optimism, with interest rate movements, inflation, and European economic growth cited as top concerns for the industry. This backdrop creates a unique set of opportunities and risks for investors in the European luxury property market.

Evolving Market Trends

Interest rates, inflation, and growth are pivotal, influencing 75% of the industry’s outlook for 2025. Key cities like London, Paris, and Madrid are spotlighted as prime locations for investment and development, driven by their robust infrastructure and global appeal. This year, there’s a stronger emphasis on niche, operational asset classes underpinned by global megatrends, such as decarbonisation, energy transition, and urbanisation, pointing towards a shift in investor appetite towards more resilient and future-proof sectors.

ESG: A Licence to Play

The importance of ESG in real estate has escalated, transforming from a nice-to-have to a critical investment criterion. This shift is propelled by the recognition of ESG’s value addition rather than its cost. Retrofitting and repurposing buildings are increasingly preferred routes to securing prime real estate assets, highlighting a growing reticence towards new development. The sector’s response to ESG challenges, including high construction costs and labour shortages, underscores the industry’s commitment to sustainable and responsible investment practices.

Strategic Insights for Investors

As an investor, staying informed on these dynamics is crucial. I keep a close pulse on the market through comprehensive reports and industry analyses. This knowledge not only informs my investment strategy but also enables me to identify emerging opportunities in a landscape marked by uncertainty. By focusing on cities with strong investment potential and aligning with the growing importance of ESG, I aim to build a portfolio that is not only financially rewarding but also sustainable and resilient in the face of future challenges.

In navigating the 2025 European luxury real estate market, investors must adapt to the evolving landscape, prioritising locations with development potential and aligning with the indispensable ESG criteria. The current climate presents both challenges and opportunities, underscoring the need for discipline, patience, and strategic foresight in investment decisions .

My Strategy for Success in European Luxury Property Investment

Key Criteria and the Role of Network and Research

When selecting luxury properties in Europe, my strategy hinges on meticulous research and a robust network. Criteria such as location prestige, architectural uniqueness, and potential for value appreciation guide my decisions. The significance of a well-established network cannot be overstated—it offers access to off-market deals and insider insights, crucial for staying ahead in the competitive luxury real estate market.

A Success Story: The Turin Triumph

A standout in my investment journey was a mansion in Turin. Identified through extensive market analysis and leveraging my network, this property stood out for its historic significance and architectural grandeur, ticking all boxes of my investment criteria. The decision to invest was backed by predictive analytics on market trends and a comprehensive evaluation of the property’s unique value proposition.

The outcome? A substantial appreciation in value within a year, coupled with high rental demand. This success story underscores the effectiveness of my strategy, blending research, network strength, and a keen eye for properties with exceptional potential. It’s a testament to the power of strategic investment in navigating the complexities of the European luxury real estate market.

Navigating the Luxury Real Estate Maze

Facing the Market: Access and Competition

Investing in luxury European properties comes with its share of challenges, notably gaining access to premier listings and standing out amidst fierce competition. The exclusivity of the luxury market means that many prime properties are sold through private networks before they even hit the open market. Additionally, the high level of competition from both individual and institutional investors makes it crucial to act swiftly and decisively.

Overcoming Obstacles: A Personal Tale

My approach to overcoming these hurdles involves a combination of leveraging technology for market insights and building strategic partnerships. A notable instance was securing a luxury villa in the South of France, a market known for its exclusivity and high competition. By utilising a bespoke property intelligence platform, I identified the opportunity before it was widely advertised. Simultaneously, a partnership with a local real estate expert provided the necessary in-road to negotiate directly with the seller. This combination of technology and local expertise not only facilitated access but also positioned me advantageously in negotiations, ultimately securing the property at a favourable price.

These experiences underscore the importance of innovation and strategic collaboration in navigating the complexities of the European luxury property market. By embracing technology and fostering strong partnerships, I’ve been able to overcome significant barriers to entry and competition, paving the way for successful investments.

The Horizon for European Luxury Real Estate

Anticipating Market Trends

The European luxury real estate market is poised for evolution, influenced by changing investor preferences and global economic dynamics. My insights, drawn from ongoing market analysis, suggest a growing emphasis on sustainability and technological integration. Luxury properties that embody eco-friendly design and smart home features are expected to dominate the market, aligning with a broader shift towards environmental consciousness and digitalisation.

Furthermore, I foresee the resurgence of secondary cities as luxury investment hotspots. As remote work becomes more entrenched, affluent buyers are seeking spacious, luxury accommodations outside traditional metropolitan areas, driving demand in previously overlooked locations.

Strategic Portfolio Expansion

My aspiration to expand my luxury property portfolio is rooted in these anticipated trends. I plan to diversify investments across different European regions, focusing on properties that offer sustainability and modern amenities. To adapt to market changes, I’m strengthening my network of local experts in emerging luxury markets and investing in technologies that provide real-time market analytics.

This forward-looking approach is designed to not only anticipate but capitalise on the future shifts in luxury real estate investment, ensuring that my portfolio remains resilient and growth-oriented amidst changing market conditions. By aligning investment strategies with emerging trends, I aim to continue achieving success in the European luxury real estate market, maximising both value and sustainability.

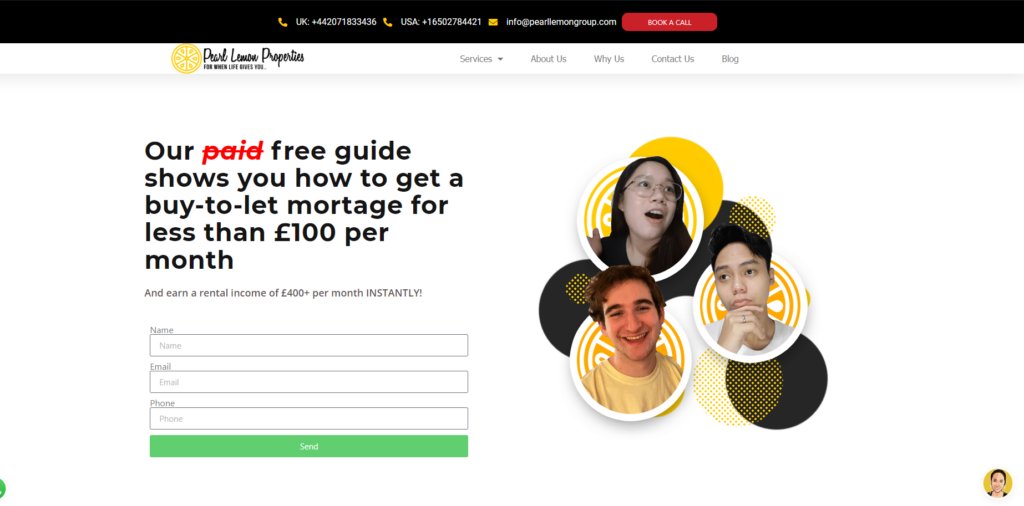

Why Pearl Lemon Properties is Your Ideal Partner

Tailored Strategies for Discerning Investors

Pearl Lemon Properties stands at the forefront of catering to the nuanced demands of European luxury home buyers. Our bespoke investment strategies are meticulously crafted, reflecting a deep understanding of the luxury real estate market’s intricacies. We pride ourselves on our proven track record of securing properties that not only meet but exceed our clients’ expectations in terms of value, luxury, and uniqueness.

Understanding Beyond the Financial

Investing in luxury real estate is as much an emotional decision as it is a financial one. At Pearl Lemon Properties, we comprehend the profound emotional connection our clients seek to establish with their investments. Our approach goes beyond mere transactions; we strive to understand and align with your aspirations, ensuring that every investment resonates with your lifestyle and long-term goals.

Contact Us

Are you ready to explore the pinnacle of European luxury real estate? Allow me, Deepak Shukla, and my team at Pearl Lemon Properties to guide you through a curated selection of exquisite properties that promise not just a home, but a legacy. Reach out today to begin your journey with a partner who values your dreams as much as the returns on your investment.