Introduction: The Allure of European Property Markets in 2025

As 2025 unfolds, my fascination with European property markets intensifies, driven by the economic resurgence and rich investment opportunities post-pandemic. Europe’s journey to recovery has been impressive, opening doors for investors to seize a landscape teeming with potential. This revival, fueled by the European Union’s commitment to stimulating investment through low-interest rates and supportive policies, lays the foundation for sustainable growth. As a property investor, these conditions are inviting, promising both rental yield and long-term value appreciation.

Diversifying into European real estate aligns with my strategic goals, offering access to a diverse array of markets, each with unique prospects. From vibrant urban areas in Western Europe to the promising markets of Eastern Europe, the continent’s variety is its strength, providing economic and geographic diversity essential for a resilient portfolio. The current market conditions present an attractive entry point, underscored by stability and growth prospects, making now an opportune moment to invest. As I navigate 2025, the compelling case for European property investment is clear, promising not only financial returns but also a robust foundation for future expansion.

Understanding the European Property Landscape in 2025

Market Trends and Dynamics

The European property market in 2025 is shaped by several key trends and dynamics, reflecting a diverse and evolving landscape. The office market, particularly in Prague, has seen a shift with a vacancy rate of 7.4%, and a significant reduction in new office space completions is expected, possibly leading to an undersupply and renewed rental growth in prime city centre locations. This shift is partly due to companies adjusting space requirements for hybrid workstyles, indicating a potential influx of second-hand office spaces becoming obsolete.

Denmark stands out with a strong economic outlook, forecasted GDP growth of 1.8%, and the lowest unemployment rate in the Nordics. The Danish real estate market is expected to see increased investment activity, especially in residential and logistics sectors, driven by ESG considerations and demand for senior living and student housing.

Finland’s property market is showing signs of alignment between buyers and sellers on pricing, with a forecasted economic growth of 0.8%. The logistics sector, supported by steady occupier demand, presents value-add investment opportunities, especially in secondary locations due to a lack of prime assets (Knight Frank).

The Role of ESG

Environmental, social, and governance (ESG) factors are increasingly influential, with a strong consensus on their importance to future real estate capital values. This is partly due to high construction costs and labour shortages, highlighting the industry’s understanding of ESG investment value.

Key Investment Sectors

Prime CBD Office Stock:

Low vacancy rates and resilient economic growth prospects make prime CBD office stock in cities like Paris, Madrid, London, and Copenhagen attractive.

Modern Logistics Assets:

With a focus on ESG credentials, these assets, especially those providing market reversion in rents, are drawing significant investor interest.

New PBSA Schemes:

The rise in domestic and international students, especially in Southern Europe, highlights the demand for student housing.

Life Science and European Data Centres:

Increased investment in digital health and the need for data centre facilities in Tier 2 cities underscore the sector’s growth.

Investment and Economic Outlook

The European Real Estate Market Outlook for 2025 indicates a cautious yet optimistic investment landscape, with expectations for a gradual recovery influenced by the alignment in pricing expectations and the impact of ESG factors on investment decisions.

This overview underscores the importance of strategic investment choices in the European property market, emphasising the role of economic resilience, ESG factors, and the evolving dynamics of office and logistics spaces. Investors are encouraged to remain adaptable, focusing on sectors with strong growth potential and ESG credentials.

Key Markets to Watch in 2025

Portugal’s Golden Visa Programme: A New Direction

The Portuguese Golden Visa, a flagship for attracting non-EU investors through real estate and other investments, has undergone significant changes. As of October 2025, the programme no longer accepts real estate purchases as a qualifying investment, shifting focus towards venture capital, private equity funds, and donations to arts or research activities. This redirection aims to alleviate the housing crisis by encouraging investments in sectors that promise sustainable economic growth. For investors, this presents a unique opportunity to contribute to Portugal’s economy while gaining residency and, eventually, an EU passport without the requirement of a minimum 6-month stay.

Germany: Economic Stability and Growth

Germany remains a cornerstone of economic stability and growth within the EU. Its robust economy and housing market continue to attract investors looking for secure and profitable investments. Germany’s appeal lies in its strong industrial base, technological innovation, and a comprehensive approach to sustainability, making it a prime location for those interested in long-term investment in residential and commercial properties.

Eastern European Markets: Poland and Hungary

Eastern European countries like Poland and Hungary present emerging market potential with high growth opportunities. These markets are increasingly appealing due to their growing economies, rising property demand, and relatively lower entry costs compared to their Western European counterparts. Investors are drawn to these regions for their potential for significant returns on investment, driven by ongoing development, EU funding, and improving infrastructure.

These three markets—Portugal, Germany, and Eastern Europe (with a focus on Poland and Hungary)—offer diverse investment landscapes that cater to various investor preferences and strategies. From Portugal’s reshaped Golden Visa programme to the traditional economic strength of Germany and the emerging potential in Eastern Europe, investors have ample opportunities to diversify and strengthen their portfolios in 2025.

Strategic Approaches to European Investment

Emphasising Research and Partnerships

In my journey through property investment, a key strategy has been a heavy reliance on detailed market research and forging robust partnerships. The European market, with its diverse investment landscape, necessitates a deep understanding of local market dynamics. This is where trusted local partners and sourcing companies become invaluable. They provide insights into the nuances of each market, ensuring investments are both strategic and informed.

The Advantage of Off-Plan Purchases

My personal experiences with off-plan purchases have been notably positive. Getting in early on developments allows for significant capital appreciation by the time of completion. It’s a strategy that requires patience and a good understanding of future market trends, but the rewards can be substantial.

Investing in Student Accommodation and Leveraging Technology

Student accommodation offers a stable investment, particularly in cities with large student populations. The demand is consistent, and the returns can be attractive. Moreover, leveraging technology for market analysis has been a game-changer. Advanced analytics and AI-driven tools provide a competitive edge, enabling better decision-making by predicting future market movements.

These strategic approaches—anchored in research, partnerships, off-plan investments, and technology—have been instrumental in navigating the complexities of the European property market.

Why Europe, and Why Now?

Unveiling the Strategic Value

Investing in European property in 2025 stands as a beacon of opportunity, underscored by my deep conviction in the market’s vast potential. The continent’s unique economic landscape presents an unmatched avenue for growth and diversification. Reflecting on my recent ventures, the positive outcomes and promising prospects only reinforce my belief in Europe’s real estate market.

Seizing Opportunities Amidst Change

The current economic conditions, marked by a resurgence post-pandemic and significant policy shifts, especially in investment programmes like Portugal’s Golden Visa, create a fertile ground for investments that promise both short-term gains and long-term appreciation. My engagements, particularly in burgeoning markets and strategic off-plan purchases, exemplify the wealth of opportunities ripe for the taking.

A Call to Action

I encourage investors to look beyond the horizon, to see Europe not just as a series of markets, but as a canvas of potential. Consider how European property could complement and enhance your investment portfolio, tapping into the continent’s rich diversity, stability, and growth prospects. Now is the moment to leverage these opportunities, charting a course towards financial growth and security within the vibrant tapestry of European real estate.

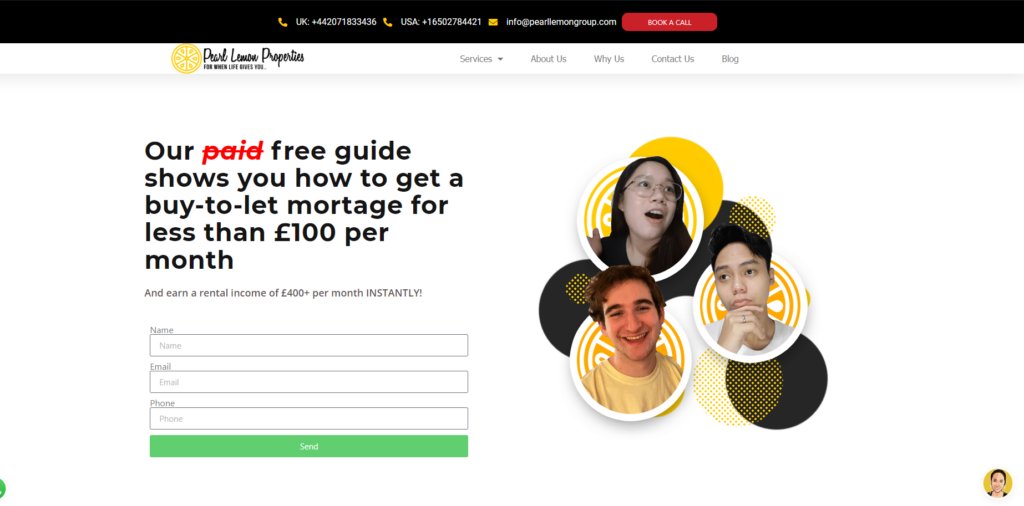

Start Your European Property Investment Journey with Pearl Lemon Properties

Discover the Potential with Pearl Lemon Properties

Embark on a journey into European property investment with Pearl Lemon Properties, where our bespoke approach meets your investment needs. By leveraging in-depth market research, cutting-edge technology, and extensive industry networks, we’re here to guide you through the complexities of the European market. Our goal? To secure investments that are not only profitable but also perfectly aligned with your strategic goals and risk tolerance.

Tailored Investments Made Simple

At Pearl Lemon Properties, we understand the value of a hands-off investment experience that doesn’t compromise on personalisation. Let us navigate the intricacies of the European property landscape for you, ensuring that your investment journey is as seamless as it is successful. Whether you’re new to property investment or looking to expand your portfolio, we’re here to unlock the doors to Europe’s most lucrative markets. Start transforming your investment aspirations into reality with Pearl Lemon Properties today.