The process of obtaining a mortgage can be stressful but this is an important step to getting your new home. So the process is definitely worth it!

Let’s go over the process of getting a mortgage for a new house by deciding which mortgage works best for you.

Before we get into the rest of the article, let’s talk about what a mortgage is.

A mortgage is a type of loan that people use to buy a home such as yourself. Now you may have already known that but there’s much more to it. So let’s dive deeper.

According to Consumer Finance,

“A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you’ve borrowed plus interest.”

Now that seems simple enough but to prepare you, even more, let’s talk about the 6 common mortgage types.

Common Mortgage Types

There are a lot of mortgage types but I will focus on the most common types with you and explain their pros and cons.

- Fixed-Rate Mortgage

- Variable Rate Mortgage

- Standard Variable Rate (SVR)

- Discount

- Tracker

- Capped rate

Fixed-Rate Mortgage

When the interest charged stays the same for a certain number of years, it’s called a fixed-rate mortgage. The duration can vary but the average duration is about 2-5 years. With this type of mortgage, you need to watch out for hidden fees. This is especially important if you plan on leaving your deal early.

Pros:

- The rate stays the same throughout to help you with budgeting. You don’t have to worry about any rates increasing unexpectedly.

Cons:

- Fixed Rates are typically higher than variable rates.

- If interest rates fall during your year fix you won’t benefit and your rate remains unchanged.

It is also helpful to search for a new mortgage deal before your current one ends.

If not, you’ll be stuck with your lender’s standard variable rate when your deal ends. This isn’t ideal because your lender’s rate will be typically higher.

Variable Rate Mortgages

A variable-rate mortgage allows your interest rate to vary and change at any time. Thus it is smart to save up just in case your payments rise. These typically start low and then increase so they can help you save up.

Variable-rate mortgages come in various forms:

- Standard Variable Rate (SVR)

- Discount

- Tracker

- Capped rate

Standard Variable Rate

This is the most commonly used mortgage that lenders charge. Unless you choose to take another mortgage deal, the rates will last.

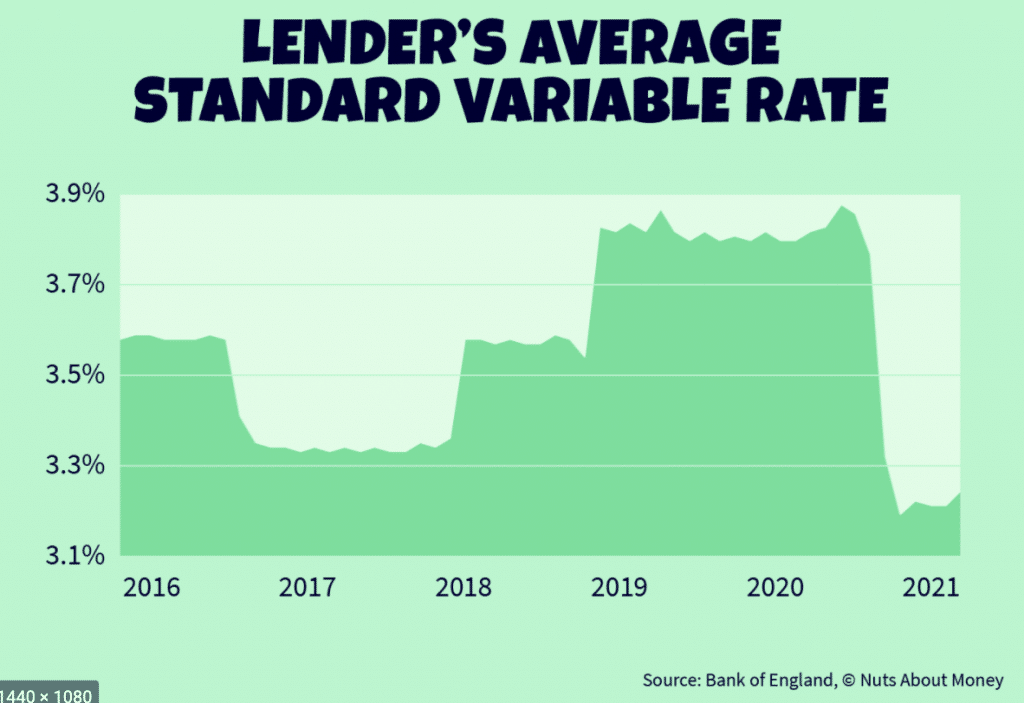

Interest rates are likely to rise and fall so keep that in mind!

Pros

- You have a bit more freedom since you are allowed to leave your deal any time at no extra charge.

Cons

- Since this is still a variable rate, your rate can change at any time.

Discount Mortgages

For discount mortgages, you receive a discounted price from the lenders SVR – standard variable rate – and it only applies for 2-3 years. But keep in mind that every lender is different. The amount you pay with a discount mortgage can still cost more than other lender’s SVR.

The discount mortgage you find can be so high that the discount makes it appear cheaper.

Thus the discount brings the rate down but does not make it necessarily cheaper than a different lender.

Pros

- The rates are often cheaper in the beginning. If the lender cuts off their SVR, you will pay less each month.

Cons

- Your lender can choose to raise the SVR at any time.

Tracker Mortgage

A tracker mortgage will be in sync with another interest rate. The tracker mortgage is typically aligned with the Bank of England’s base rate plus a small percentage.

Pros

- If rates fall, so do yours!

Cons

- If the rates rise, so do yours!

Be on the lookout for what your lender says in the final contract. They can raise the rate if the base rates haven’t gone up in a while.

Capped Rate

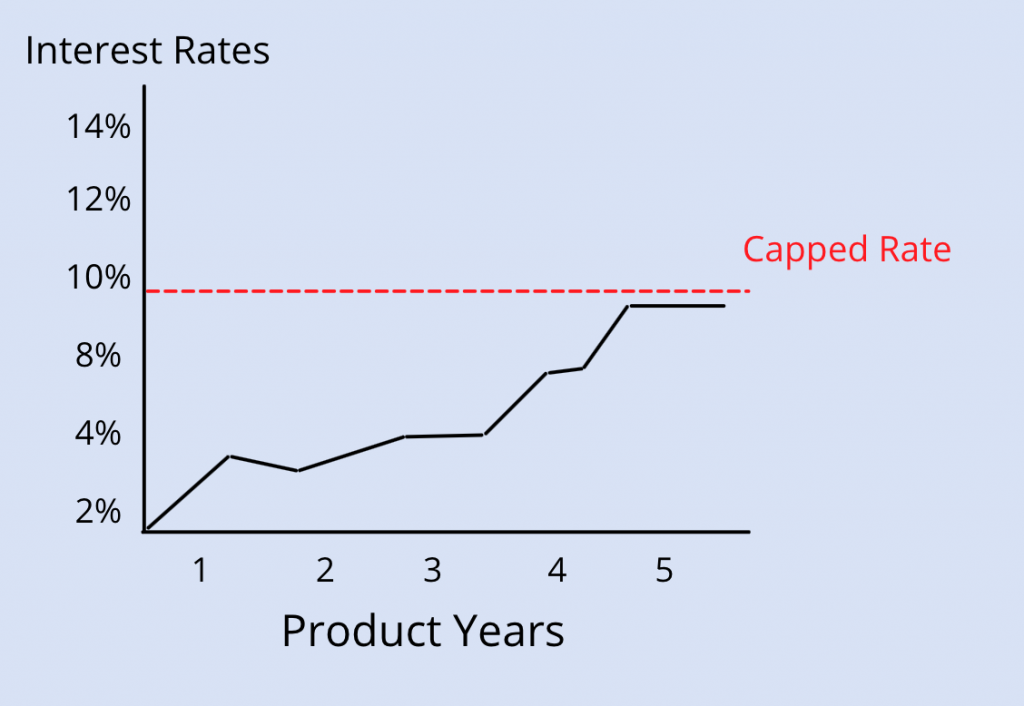

For a capped rate mortgage your rates align with the lender’s SVR but there is a cap on their rates. Meaning that the rates can’t rise above a certain level.

As you can see with the variable rate, interest rates can rise.

Now let’s look at our pros and cons.

Pros

- Trust can be developed because of the assurance that the rates won’t rise above a certain level.

- Your rates can fall!

Cons

- As you may have guessed, the cap tends to be high – so see if this is worth it.

- The overall rate is typically higher.

- The lender can change your rate at any time and even keep it up to the level of the cap if you make them upset.

Now that we have discussed the mortgage types let that information sink in.

We can finally move on to the actual steps of getting a mortgage to buy a house!

5 Steps to Buying a New House

Mortgage types can vary from country to country and the process of buying property can have different requirements.

With the UK as our main context, I will explain how and when to get a mortgage for a new house.

Here are the steps to buying a new home:

- Find a property within your budget

- Make an Offer

- Find your Solicitor and Surveyor

- Finalize

- Last Steps

Find a Property within Your Budget

If you have not decided what your budget is, then I would suggest taking a look at houses in your desired location to see what the average price is. This can help you decide how much you are willing to pay for a house.

After you have decided on a budget, look for the property that suits you!

Before we carry on, you may want to review your credit score and debt.

At this stage, you can choose the mortgage that is best for you! Refer back to my list of mortgages if you need to.

Once you make this decision, you can get a mortgage in principle (from an Independent Finacial Adviser, mortgage broker, or lender). This leads to how much the lender is likely to charge as your interest rate.

Make an Offer

Now you have everything prepped to make an offer! At this time you are ready to submit your application.

Keep in mind this does not guarantee that the lender will choose you. So hopefully you can score your number one choice.

It is still smart to have a couple of options just in case you are not chosen.

The lender may withhold any requirements that they are looking for to keep their options open. This can include a minimum credit score or certain requirements that a lender looks at in requested documents.

Find your Solicitor and Surveyor

Your solicitor handles any legal work around the property and your surveyor examines or “surveys” the property to check for any problems.

When a survey is done by the lender this is a valuation survey. They are supposed to make sure that the property is worth the amount you will pay for. Although lenders aren’t necessarily in the professional position to determine the quality of a house.

The average cost of this is £150-£1,500 while some lenders won’t charge for this service.

If you choose not to have a valuation survey you can choose a few types of property surveys.

- RICS condition report – suitable for newly built homes and no advice or valuation is given. The average cost is £250.

- RICS homebuyer report – suitable for properties in a reasonable condition. This is a thorough and detailed survey that includes a valuation. Average cost: £400+.

- Building or structural survey – suitable for all residential properties. Best for older homes compared to the other surveys. Typical cost: £600+.

Keep in mind that when you are getting a mortgage, a loan, or valuation survey – your credit score matters. I highly recommend that you find out your credit score ahead of time to be prepared.

Finalize

Once the survey of your choice is complete you want to renegotiate the price due to possible uncovered issues.

Now I won’t lie to you, this is where the process gets frustrating. Keep an open mind that at this stage the lender can still choose to reject your application.

Due to the tensions of negotiating, your lender can do this if they feel you are causing too much stress. This is unfortunate, but in the long run, if they choose not to do anything about possible problems during your survey then it is not worth the time.

Your lender can also choose to go with a buyer who is willing to pay higher interest rates. Don’t let this influence you to go over budget. I know the process is stressful but it is not worth getting into debt.

Now, say that your application was approved or you are waiting, you can still pull out if you choose to. If not, your mortgage is ready to be finalized and contracts can be exchanged!

While you are looking at the contract, have your solicitor look over it with you. Now you and the lender are committed to the sale and you just have to sign!

Last Steps

The final steps include any fees (depending on the lender and solicitor so keep an eye out).

You may have a mortgage account fee so double-check with both your lender and solicitor.

Most importantly don’t forget to pay your solicitor’s bill and anyone else you hired during this process.

If your home is over £250,000, You will need to pay a Land Transaction Tax. If your home is over £500,000 then you have 14 days to pay Stamp Duty. If you are unsure, your solicitor should arrange this anyways but I would ask to confirm.

If you are using a moving company then you want to budget these costs ahead of time.

Helpful Tip: it is cheaper to move during the weekday.

Before saying goodbye to your solicitor please ask to make sure what specific payments need to be made. You can ask this in the early stages so that you are prepared for it.

Conclusion

Hopefully reading through the process didn’t cause too much stress but it is better for you to be mentally prepared.

So carefully read before taking a step into this process and do more research. It doesn’t hurt to be over-prepared especially when deciding on a mortgage.

I hope that in the end, you have the house you want with the mortgage of your choice!