Property Data Review

What is Property Data?

Property investment is not a walk in the park.

To make sound decisions, it’s essential to have all the information you need. This requires a lot of research and can be quite time-consuming.

This is where Property Data comes in.

Property Data provides investors and developers with analytics and data that guide their decision-making process.

This tool could be your right-hand man in your property investment journey. Property Data has features that are dedicated to guiding you in your research process, property evaluation journey, and purchasing decisions.

The main features are divided into three categories:

Research

- This is a research tool that can help you decide where to invest.

- Here you can research different properties based on local data, postcode data, and other factors that narrow down your search.

Source

- This is a sourcing list with an algorithm designed to help you find investment properties from a wide range of options.

- The sourcing list is updated daily and shows you whether a property has been repossessed, become unmodernised, or has a price reduction.

Evaluate

- This feature helps you with the appraisal of your investment property.

- You can use tools like the mortgage finder to find the right options for you.

Property Data could be a great tool for people who are serious about this kind of investment.

I’ll take a closer look at these features, show you the payment plans, and explain the benefits of using Property Data.

Let’s begin, shall we?

Main Features of Property Data

Property Data is organised into three main features. Each feature has its own set of tools as well. So we’ll analyse the main features and the most relevant tools in more detail here.

Research

A great way to make bad investments is to skip the research stage. It’s a long, tedious process, but it is the single most important step before making purchasing decisions.

Since most investors don’t have much time to conduct research from scratch, Property Data allows users to streamline this process.

The Research feature has 6 main tools including:

- Local Data

- Yield Hotspots

- Chart Library

- Postcode Data

- Newsroom

- Browser Extension

Each of these tools is designed to make your research process as detailed and informative as possible.

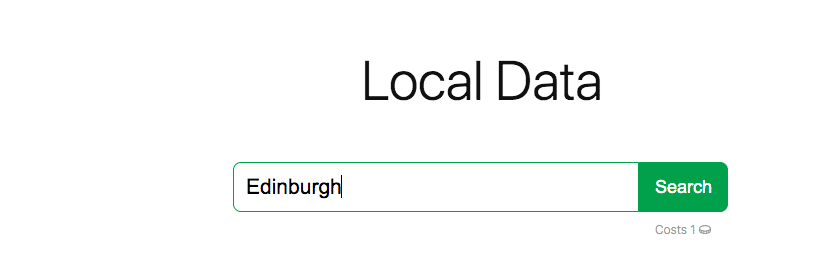

Local Data

This is where you can make local searches according to a property’s location.

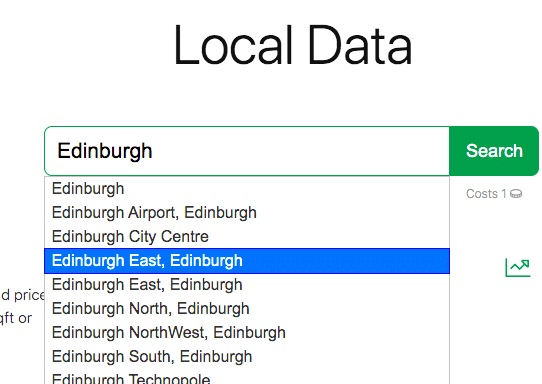

You simply type in the place you want to research. In this case, I’m interested in properties in the city of Edinburgh, Scotland.

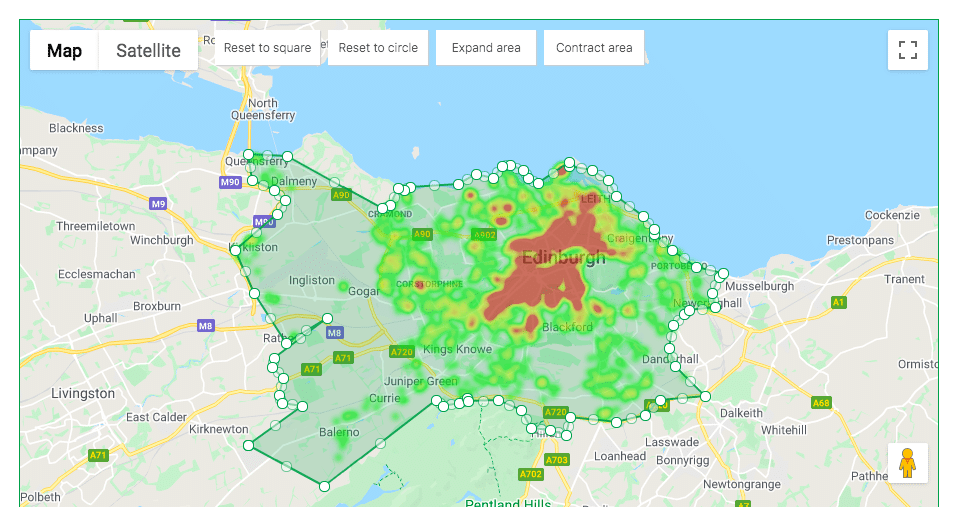

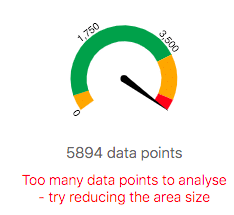

This is the result that the search generated. Evidently, this is too big of a space to analyse, and it’s best to narrow down the search area to a specific part of Edinburgh.

This scale on the left-hand side of this page indicates if there are too many data points. This means that I have to reduce the area size and choose a smaller location for this search.

When I returned to the search bar, I could easily find other specific locations within Edinburgh. In this case, I’ll focus on Edinburgh City Centre for my research.

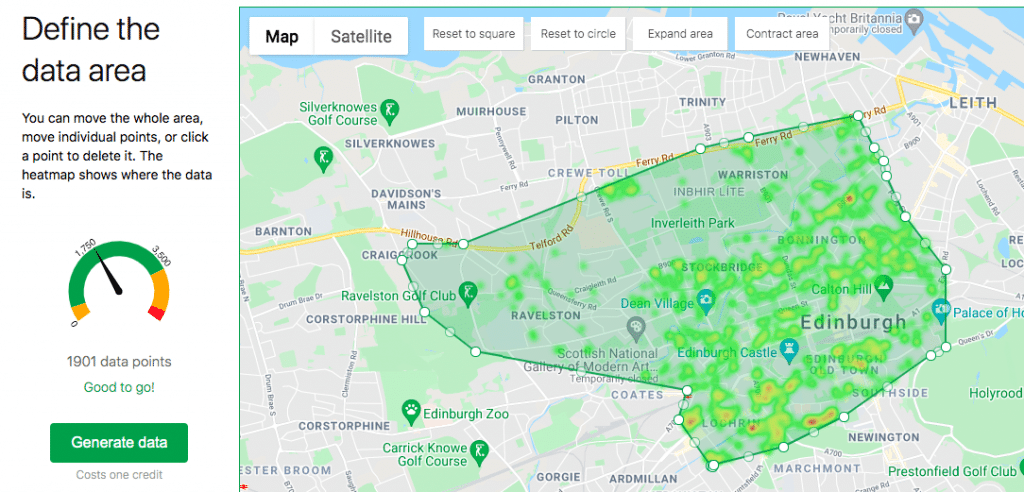

This was the result:

On the left-hand column, you can see that this is a good area size and I can now generate data about this particular location.

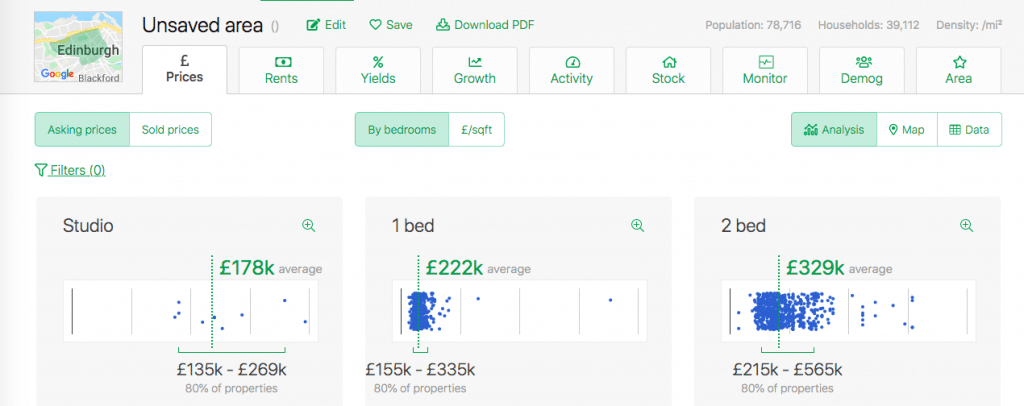

Just like that, I have details about the cost of different properties in the area.

See how easy that was?

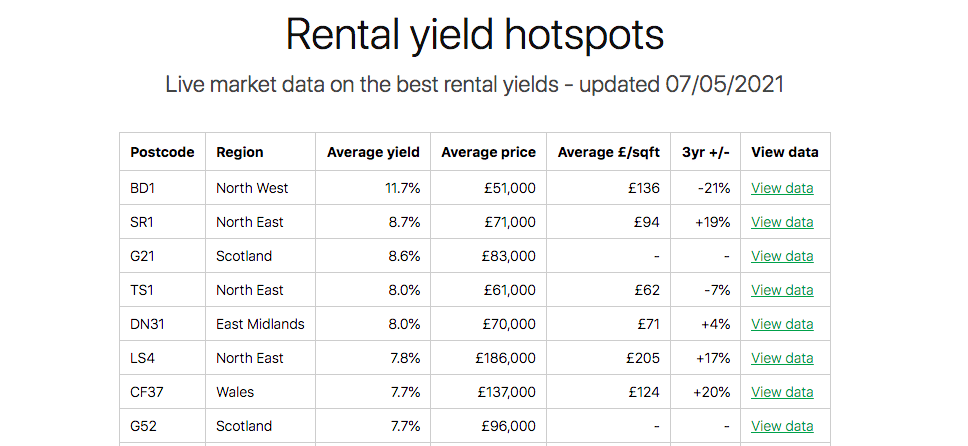

Yield Hotspots

If you want to research properties that have the best rental yields, then you can use the Yield Hotspots feature to do that.

This is where all the best rental yields are reported, and they’re organised according to postcode, region, and average yield.

This database is updated on a daily basis, and you can view individual data to get a clearer overview.

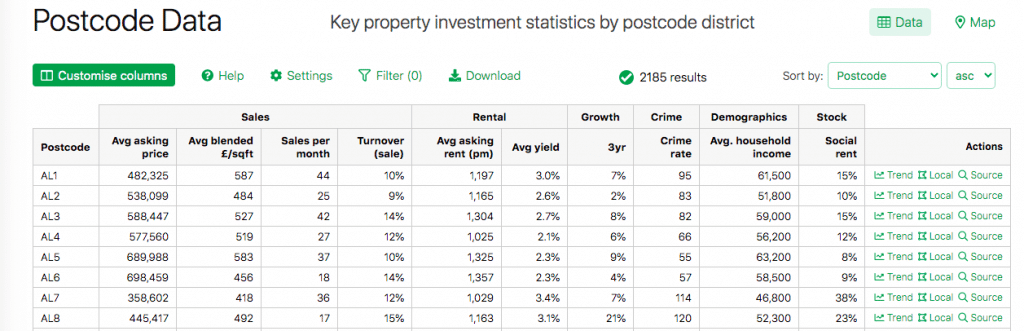

Postcode Data

If you want to narrow down your research according to postcodes, then you can do that with the Postcode Data tool.

Seriously, everything you need is generated for you.

You can analyse the following data:

- Postcode

- Average asking price

- Sales per month

- Average asking rent (per month)

- Average yield

- Crime rate

- Average household income

The postcode data is very detailed, and it can give you a good foundation for building an investment strategy.

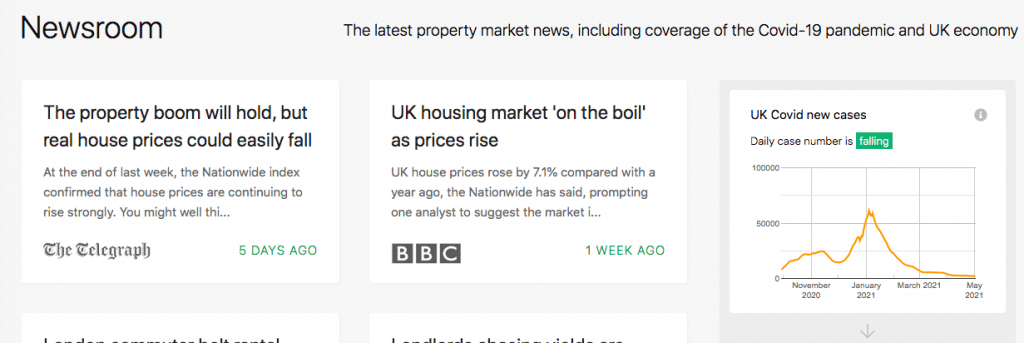

Newsroom

An additional thing that I think is pretty cool is the Newsroom tool. This is where you can find all the latest news that could affect the property market.

It looks like this:

All this market news can impact the property market and the UK economy. So it’s fantastic that Property Data users can access it all in one place.

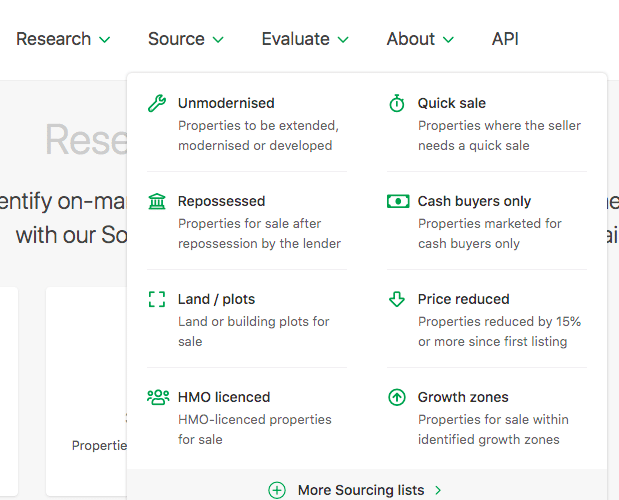

Source

Using the Source feature, you can easily find on-market opportunities in a database that uses 28 different investment strategies.

The Source feature has 8 main categories including:

- Unmoderised properties

- Repossessed properties

- Land and plots for sales

- HMNO-licenced properties

- Quick sale properties

- Cash buyers only properties

- Properties with reduced properties

- Growth zone properties

These categories make it easy for you to find the exact properties you are looking for.

Unmodernised Properties

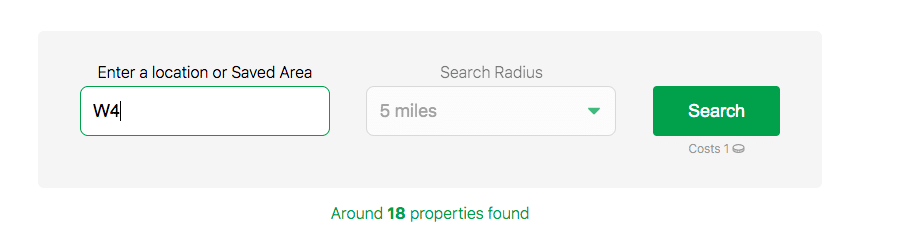

All you have to do is input the location you’re looking for in the search engine.

Once you do that, you’ll be informed about how many properties were found in that location.

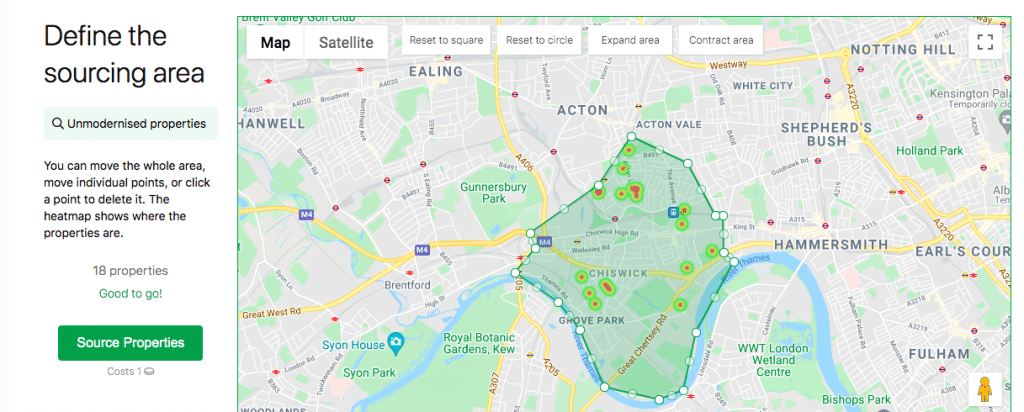

This is what the result looks like:

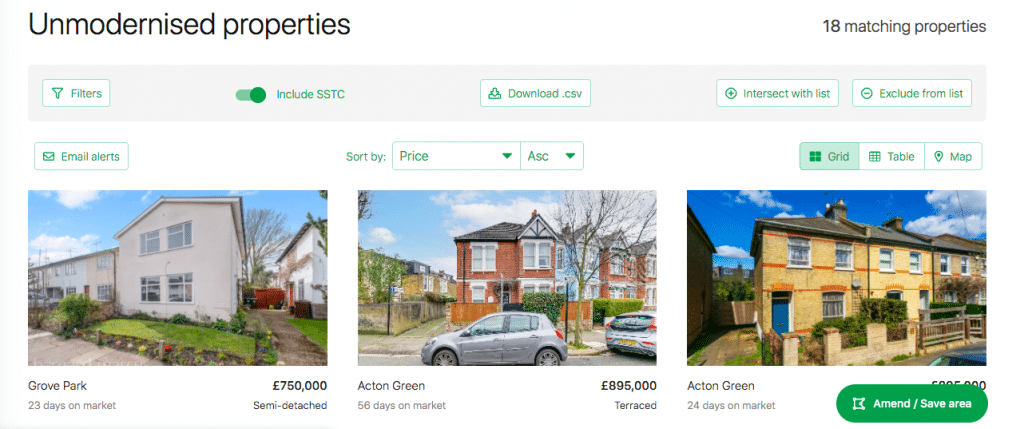

You can click on the “source properties” button on the left-hand column to get more information about the available properties in that location.

Here, you can easily access all the information you need about each individual property until you find the perfect fit.

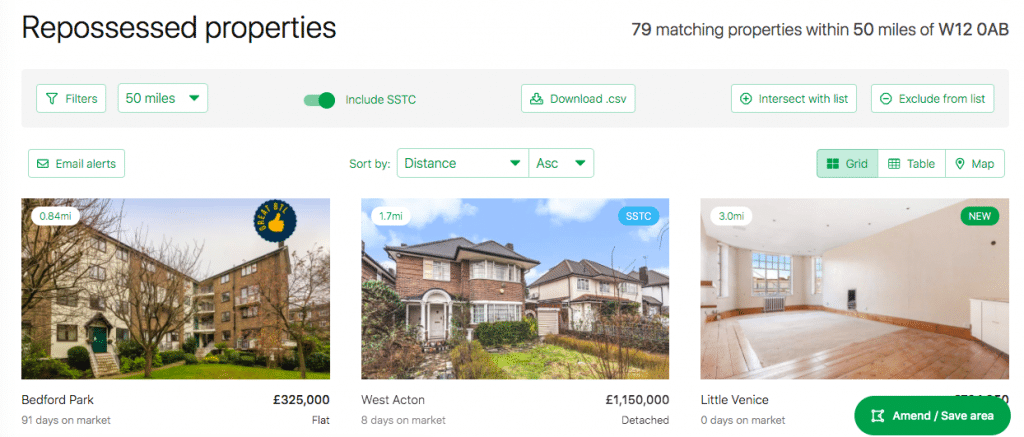

Repossessed Properties

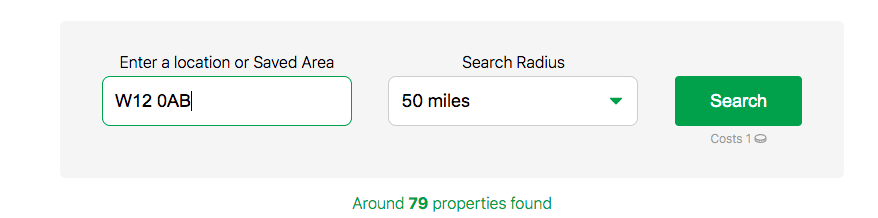

This database works exactly like the Unmodernised Property section does.

You get an estimate of the number of properties matching your search and are led to a database showing the individual repossessed properties.

All the relevant information about these properties are available to you here. You can download the information, adjust the filters, and even save the specific search area for future reference.

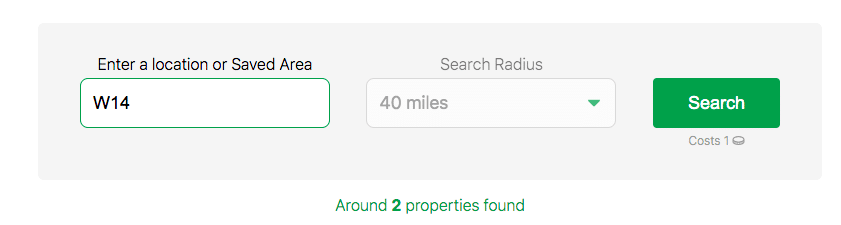

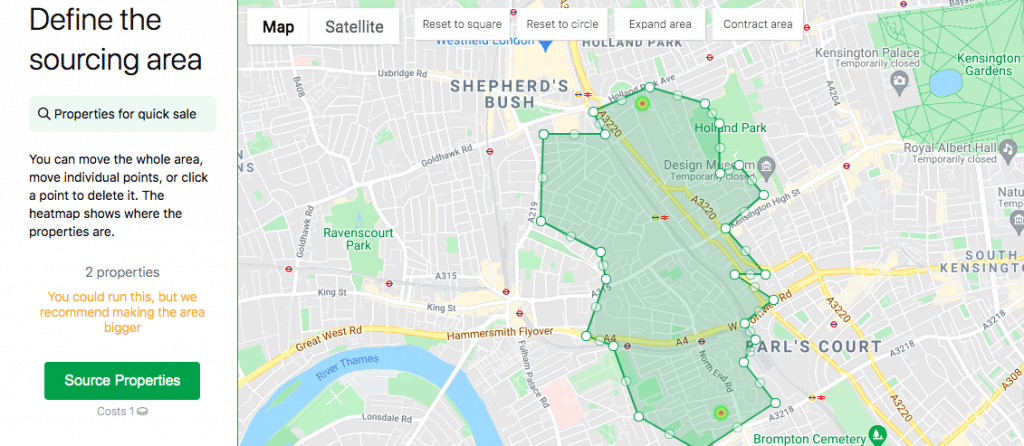

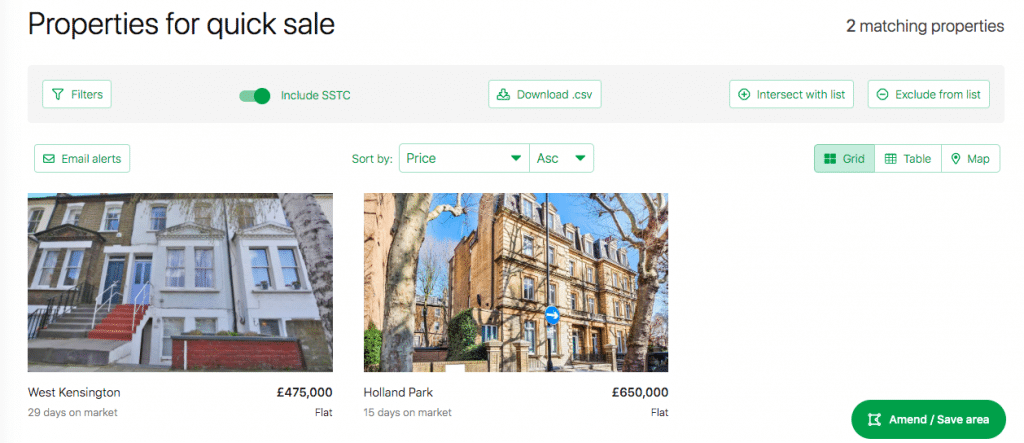

Properties for Quick Sale

In this category, you’ll find properties that are being sold quickly.

You just have to type in the location that you want to analyse and you’ll get your results within seconds.

The results from sourcing these properties are just as detailed as the previous categories we analysed.

With this, you can easily see which properties are for quick sale to make a decision about whether to purchase or not.

Price Reduced Properties

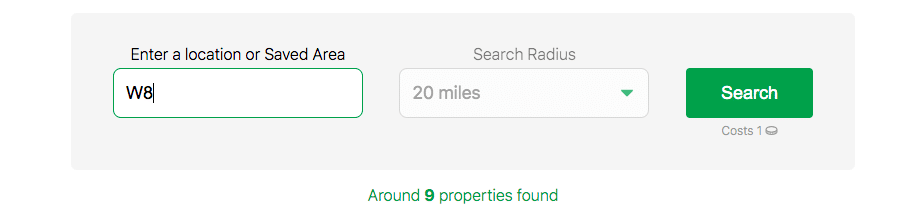

As usual, you simply type in the location that you’re searching for, and the search engine will show you how many properties match that location.

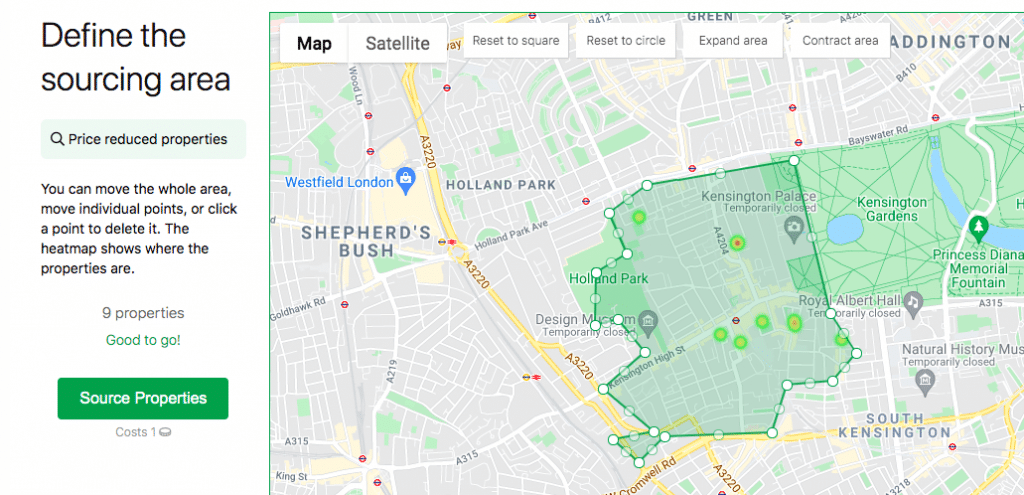

The results are also displayed on a map so that you can visualise your options better.

You can then source these properties to access more detailed information about each one.

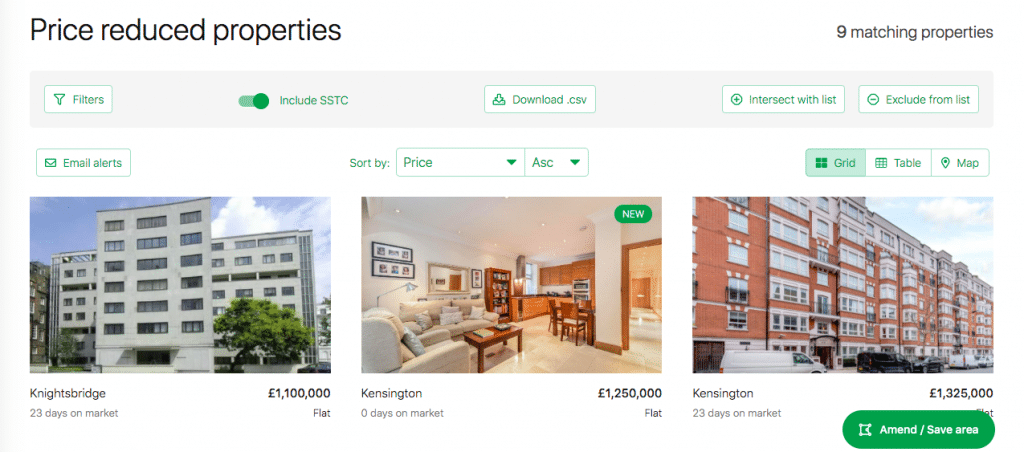

In seconds, all the matching properties are available for your perusal. This makes your research process much easier.

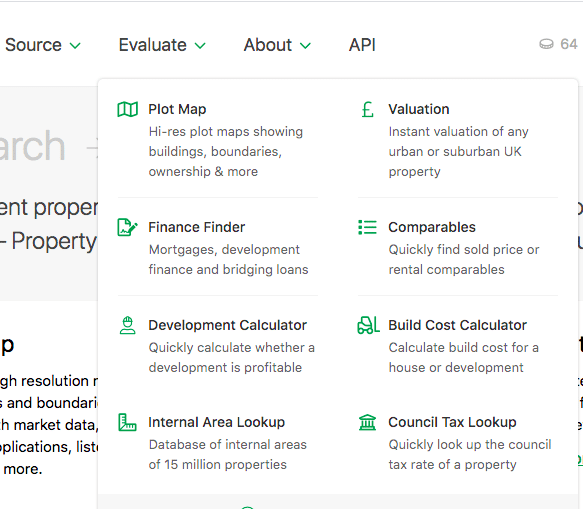

Evaluate

The Evaluate feature helps you in the appraisal process of your property. This is a crucial step to property investment.

The Evaluate feature has 8 main tools including:

- Council Tax Lookup

- Internal Area Lookup

- Build Cost Calculator

- Development Calculator

- Finance Finder

- Comparables

- Valuation

- Plot Map

With the help of these tools, you’ll be able to make appraisals with ease.

Build Cost Calculator

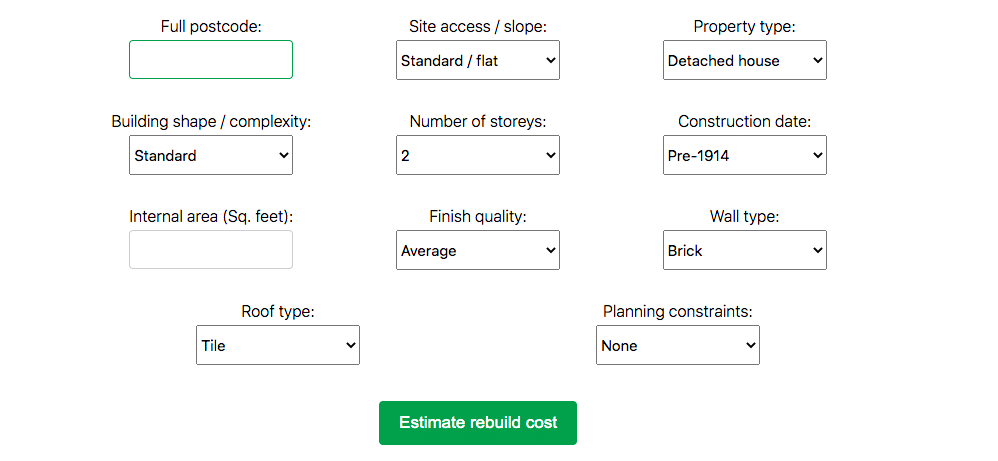

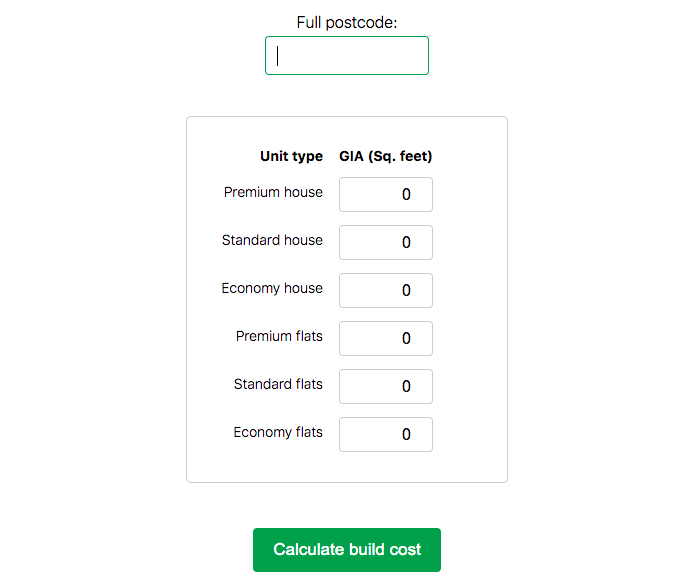

The build cost calculator is divided into two main categories:

House

- This shows you the rebuild cost for a house based on a range of perimeters

Whole development

- This gives you an estimate of the cost of a whole development anywhere in the UK

To calculate a house, you input the following information:

To calculate a whole development, you input the following information:

With this, you can easily calculate how much it will cost you to rebuilt houses or whole developments. This is valuable information to have before finalising any major decisions.

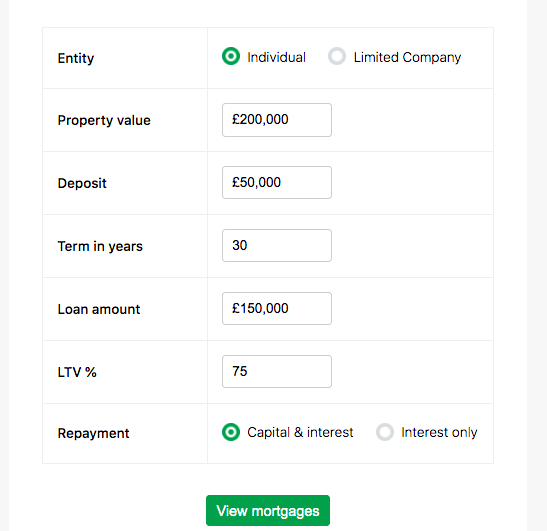

Finance Finder

This is an important feature because it provides you with information about mortgages, development and bridging finance as well.

If you are interested in researching available buy-to-let mortgages, you can also do that using this feature.

Here, you can find out all you need to know about repayment, deposits, and other factors crucial to your financial decision making.

There’s so much more that the Evaluate feature has to offer, so make sure to check it out for yourself.

Property Data: Pricing & Payment Plans

There are three main payment plans that Property Data offers. Here is a brief overview of each.

For £14/month, the Basic Payment Plan offers:

- 20 credits per month

- 4 saved local areas

- 4 saved plots

For £22/month, the Pro Payment Plan offers:

- 80 credits per month

- 15 saved local areas

- 15 saved plots

- Postcode data

- Download to PDF

For £45/month, the Max Payment Plan offers:

- Unlimited credits per month

- Unlimited saved local areas

- Unlimited saved plots

- Postcode data

- Download to PDF

- Branded PDFs

- Additional users pay £18/month

Each payment plan gives users a certain amount of credits. This is because every search costs at least one credit, so that ultimately limits how much research you can do.

For investors who are looking to build their portfolio, the Pro or Max payment plans are better options because there is more flexibility in how much you can do.

To learn more about Property Data pricing and payment options, you can visit this page.

Final Verdict

Property Data is an indispensable tool for investors who are serious about approaching investment the right way.

With this tool, you can research, source, and evaluate with ease and all in the same place.

The final verdict is: Property Data scores 100%.

If you’re a property investor, it’s almost irresponsible not to have a Property Data account.

You can sign up for your account here.

About The Author

Pearl Kasirye

Pearl M. Kasirye is the Head of Content at Pearl Lemon. She’s a professional writer, editor, and researcher who spends most of her time reading. When she isn’t reading or working, she can be found sitting on her balcony writing her own novels or planning a new impromptu trip.