The Lure of Turin for Property Investors

Turin mansion investments are quickly becoming a magnet for savvy property investors, drawn by the city’s burgeoning status as a prime location for wealth growth in Italy. With its rich cultural heritage, burgeoning tech industry, and rapidly improving infrastructure, Turin presents a compelling case for those looking to diversify their portfolios. Recent 2025 statistics underscore the city’s property market boom, highlighting significant increases in value and a plethora of investment opportunities. This northern Italian gem, with its blend of historical charm and modern dynamism, is now firmly on the map for investors seeking substantial returns in a vibrant, evolving market.

Discovering Turin: A Journey of Investment Discovery

The Initial Scepticism

My journey into Turin’s property market began with a healthy dose of scepticism. Coming from a bustling property scene in the UK, the idea of investing in an Italian city, albeit renowned for its cultural heritage, seemed like a leap into the unknown. However, my curiosity was piqued by emerging reports of Turin’s economic revival and burgeoning tech industry, prompting a deeper dive.

Conducting the Research

The research phase was eye-opening. I delved into market analyses, property value trends, and Turin’s strategic plans for infrastructure development. Conversations with local experts and investors revealed a shared optimism about the city’s future as a property investment hotspot.

A Shift in Perspective

The key factors that transformed my viewpoint were the city’s rich historical allure coupled with its modern growth trajectory. Turin’s unique blend of tradition and innovation, coupled with favourable property prices and a high potential for capital appreciation, presented a compelling case. This revelation marked the beginning of my investment journey in Turin, a decision that has since borne fruit in ways I could hardly have anticipated.

Analysing Turin’s Property Market: What the Data Shows

The Current Landscape

In February 2025, Turin’s property market showcased an intriguing mix of stability and growth. The average asking price for residential properties for sale was €1,931 per square metre, reflecting a modest increase of 0.36% compared to the previous year. This gradual upswing demonstrates Turin’s resilience and potential for steady growth, making it an attractive destination for investors. Rental properties also saw a significant surge, with the average asking price reaching €11.07 per square metre, marking a notable 12.04% increase from the previous year .

Diverse Investment Opportunities

Turin’s market is characterised by its diversity, offering a wide range of investment opportunities. The most sought-after areas, such as the Centro district, commanded the highest prices, with sales prices peaking at €3,612 per square metre and rentals at €14.75 per square metre. On the other hand, more affordable areas like Aurora, Barriera di Milano, and Rebaudengo presented lower entry points for investment, with sales prices starting at as low as €1,127 per square metre .

Key Considerations for Investors

Investing in Turin requires navigating a landscape marked by both opportunity and complexity. Potential investors should consider the city’s rich historical backdrop, which can entail specific regulations and limitations, especially for properties near cultural heritage sites. Moreover, understanding the local market trends and engaging with experienced professionals can significantly mitigate risks and enhance the investment’s success potential.

Living and Investing in Turin

Turin offers a compelling blend of cultural richness, historical significance, and modernity. With a lower cost of living compared to other major Italian cities and a vibrant cultural scene, it provides a high quality of life. The city’s diverse neighbourhoods offer a variety of lifestyles, from the bustling Centro to the tranquil residential areas, catering to different preferences and investment strategies.

Navigating Turin’s Property Market: Challenges and Opportunities

Facing the Challenges

Investing in Turin’s property market comes with its own set of hurdles. Regulatory constraints, particularly around the renovation of historic buildings, can pose significant challenges, demanding a deep understanding of local laws and patience to navigate bureaucratic processes. The competition for properties in sought-after areas is fierce, driving up prices and making bargains harder to find. Additionally, market saturation in popular districts means investors need to act swiftly and decisively to secure valuable deals.

Embracing the Opportunities

However, Turin also presents unique opportunities that savvy investors can leverage. The city’s underexplored neighbourhoods offer untapped potential for growth, often at more attractive price points than the bustling centre. Government incentives for the restoration and conservation of historic properties provide financial benefits, encouraging the preservation of Turin’s architectural heritage while making investments more feasible. Moreover, Turin’s growing reputation as a cultural and technological hub is attracting a diverse population, increasing demand for rental properties, and promising healthy returns on investment.

Maximising Property Wealth in Turin: My Proven Strategies

Focusing on Off-Plan Investments

One of the cornerstones of my property investment strategy in Turin has been the focus on off-plan properties. This approach allows for capital growth even before the construction is completed, often securing properties at below-market rates. The anticipation of Turin’s market trends and infrastructure developments has been crucial, enabling me to invest in areas poised for growth.

Leveraging Local Property Management

To ensure my investments remain hands-off, I’ve extensively leveraged local property management services. This has not only streamlined the process of renting out properties but also maximised rental yields through professional marketing and tenant management. It’s a strategy that pays dividends by freeing up my time while ensuring my investments are well cared for.

Building Relationships with Real Estate Professionals

Cultivating strong relationships with local real estate agents and professionals has been instrumental. These connections have provided insider knowledge on market trends and access to off-market deals, often before they become widely known. Trust and mutual respect with local professionals have been pivotal in navigating Turin’s competitive property landscape.

Incorporating these strategies into my property investment approach in Turin has significantly enhanced my portfolio’s value. By staying ahead of market trends, utilising professional management, and leveraging local expertise, I’ve been able to maximise my property wealth in this dynamic Italian city.

The Future of Property Investment in Turin: Trends to Watch

Embracing Technological Advancements

The Turin property market is poised for transformation with the integration of technological advancements. Smart homes and sustainable building technologies are becoming increasingly popular, offering both environmental benefits and operational efficiencies. These innovations are not only appealing to a tech-savvy demographic but also contribute to the overall value of properties, making them a wise investment choice.

Urban Development and Regeneration

Significant urban development plans are underway in Turin, focusing on the regeneration of underutilised areas and the creation of new residential and commercial spaces. These initiatives aim to revitalise the city, attracting more residents and businesses. Investors should keep a close eye on these developments, as properties in these areas are likely to appreciate in value as the projects come to fruition.

Post-COVID-19 Consumer Behaviour Shifts

The aftermath of the COVID-19 pandemic has led to shifts in consumer behaviour, with a growing preference for properties that offer more space and green areas. This trend is particularly noticeable in Turin, where there’s an increased demand for homes with gardens or proximity to parks. Such properties are expected to see higher rental yields and capital appreciation, presenting a lucrative opportunity for investors.

How to Get Started with Your Turin Property Investment Journey

Step-by-Step Guide to Investing in Turin

Market Research: Begin with in-depth research into Turin’s property market. Focus on understanding current trends, average property prices, and the most promising areas for investment.

Securing Financing: Explore your financing options early. This could include mortgages from local banks or other financial institutions. Understanding your budget and potential financial products available in Italy is crucial.

Navigating Legal Requirements: Familiarise yourself with Italy’s legal requirements for property purchases, including taxes, fees, and any specific regulations for foreign investors. Consulting with a local property lawyer can provide valuable insights and streamline the process.

Selecting the Right Property: Based on your research and financial capacity, select a property that aligns with your investment goals. Consider factors like location, potential for appreciation, and rental yield.

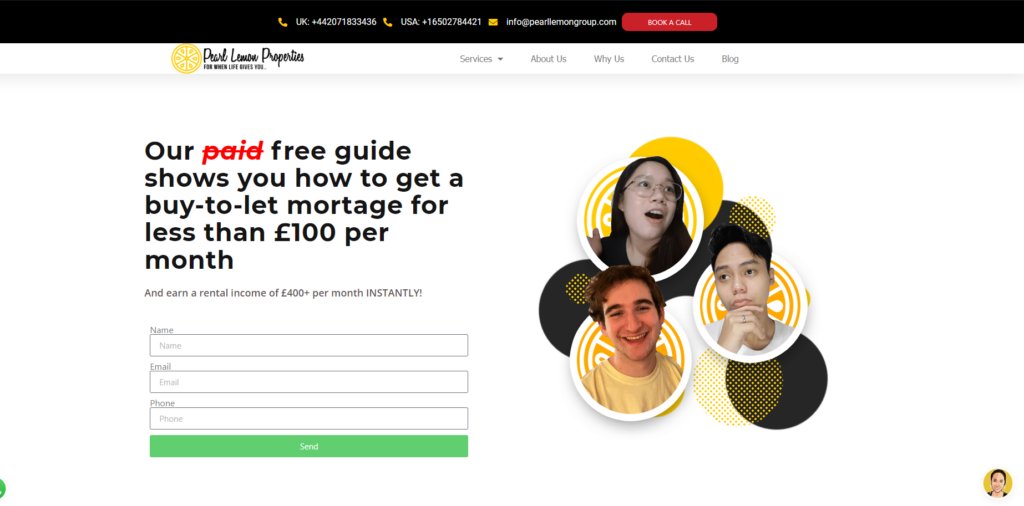

Unlock Your Property Investment Potential with Dee at Pearl Lemon Properties

Dive into the world of property investment with a trusted guide by your side. Deepak Shukla, the driving force behind Pearl Lemon Properties, brings a wealth of experience and innovative strategies to the table, helping you navigate the complexities of the market with confidence. Whether you’re looking to expand your portfolio in Turin or explore new opportunities elsewhere, my personalised approach ensures that your investment journey is both successful and rewarding.

Contact us today to discover how you can leverage my expertise for your property investment goals. Let Pearl Lemon Properties be your partner in unlocking the door to financial growth and security through savvy property investments.