Introduction: The Rising Appeal of Student Apartment Investments in Piedmont

In 2024, the trend of investing in student apartments in Piedmont has surged significantly. This trend is driven by the region’s expanding educational institutions, coupled with a steady demand for student accommodation, promising investors stable rental yields. My journey in property investment has led me to identify Piedmont as an optimal location for such investments.

The blend of robust educational growth and consistent accommodation needs makes student apartments here a compelling option for investors seeking dependable returns. This introduction lays the groundwork, illustrating why engaging in student apartment investments in Piedmont stands out as a wise choice in the current year, reflecting my insights as an adept property investor.

Understanding the Piedmont Market: A 2024 Overview

The student housing market in Italy, including regions like Piedmont, is witnessing a significant surge in demand, underscored by a substantial growth in foreign student numbers and a persistent gap between demand and supply. A 2024 outlook by Real Asset Insight highlights the overall country’s benefit from the growth in alternative asset classes like student housing, noting the potential for sector expansion due to Italy’s lowest provision rate in Europe.

The market’s attractiveness is further emphasised by the increasing interest from clients in high-quality, modern, and potentially pricier Purpose-Built Student Accommodation (PBSA), despite the existing challenge of high price levels for most students.

Further reinforcing the sector’s appeal, Savills reports a remarkable 121% growth in the number of foreign students in Italy over the past decade, with a significant portion arriving from non-Euro countries, including Asia. This demographic shift, coupled with a slight drop in domestic student registrations, has created new opportunities for investors in this emerging sector.

Despite the current supply, which fails to meet three-quarters of the demand from intra-regional and foreign students, prime yields in the student housing market remain attractive at approximately 7%, hinting at a stable investment environment.

Moreover, the student housing industry’s resilience is evident from its performance amid financial crises and the COVID-19 pandemic, with a high collection rate supported by parental guarantors and a preleasing rate of 47.3% for the 2024-2025 academic year.

However, the sector faces challenges such as rising interest rates, capital concerns, and increasing construction costs. Despite these hurdles, the entry of new players, including foreign investors and private capital, indicates a healthy and robust market with strong fundamentals.

This overview offers a glimpse into the promising yet complex landscape of student housing investments in Piedmont and Italy at large, highlighting the strategic importance of understanding market dynamics, demand-supply gaps, and investment yields for 2024 and beyond.

My Investment Strategy: Navigating Student Apartments in Piedmont

Strategic Selection Criteria

Investing in student apartments in Piedmont demands a calculated approach. My primary focus rests on properties close to universities, as their proximity significantly enhances rental demand. Additionally, I prioritise buildings that offer amenities aligned with student lifestyles, such as reliable internet, communal study areas, and fitness centres. The potential for long-term value appreciation also plays a crucial role in my decision-making process, ensuring the investment grows over time.

Understanding the Target Demographic

Recognising the preferences of the student demographic is paramount. Today’s students look beyond basic housing; they seek accommodation that supports their academic, social, and recreational needs. Integrating features that resonate with their lifestyle can substantially increase a property’s appeal and, consequently, its occupancy rates.

Why This Matters

This strategic, informed approach allows me to identify properties that not only meet the immediate needs of the student market but are also poised for appreciation in the long run. By focusing on location, amenities, and student preferences, I ensure that my investments are both lucrative and sustainable, catering to the evolving demands of the student population in Piedmont.

Navigating Financials in 2024: Student Apartment Investments in Piedmont

Investment Costs and Returns

In 2024, navigating the financial landscape of student apartment investments in Piedmont requires a keen understanding of costs and potential returns. Typical purchase prices are influenced by location, amenities, and the size of the property, with a direct impact on the expected rental yields. In my experience, focusing on areas with high student density can command higher rents, thereby optimising returns.

Financing and Economic Factors

Financing options vary, from traditional bank mortgages to more innovative financing solutions such as real estate crowdfunding. The current economic climate, marked by fluctuating interest rates and inflation, necessitates a careful approach to financing. I’ve found that locking in fixed-rate mortgages when rates are favourable helps mitigate risks associated with rising interest rates.

Personal Insights

Securing financing for my initial investments involved presenting a robust business plan to lenders, showcasing the projected rental yields and occupancy rates. I’ve also maximised returns on investments by implementing cost-effective improvements to properties, enhancing their appeal to the student market.

Why It’s Important

Understanding the financial nuances of investing in student apartments in Piedmont is crucial for success. The right investment strategy, informed by current market conditions and a clear understanding of financing options, can lead to profitable and sustainable returns. This approach has been instrumental in my investment journey, allowing me to navigate the challenges and opportunities of the 2024 market effectively.

Challenges and Solutions: Navigating Student Apartment Investments

Facing the Challenges

Investing in student apartments in Piedmont presents its unique set of challenges. Market competition is fierce, with numerous investors eyeing the lucrative student market. Property management and maintaining consistent tenant occupancy further add to the complexity. These hurdles necessitate strategic planning and innovative solutions to stay ahead.

Strategic Solutions Employed

To navigate these challenges, leveraging professional networks has been indispensable. Building relationships with university housing offices and local businesses provides a continuous pipeline of potential tenants.

Utilising property management services ensures the apartments are well-maintained and appealing to students, addressing both management and occupancy concerns. Additionally, effective marketing, particularly through social media and student portals, ensures high visibility among the target demographic.

Why This Matters

Overcoming these obstacles is crucial for the success and sustainability of student apartment investments. The strategies I’ve employed demonstrate the importance of resilience and adaptability in the face of investment challenges. By addressing issues head-on and implementing tailored solutions, investors can achieve a competitive edge and ensure steady returns from their property portfolios.

The Future of Student Housing in Piedmont: Vision Beyond 2024

Emerging Trends and Predictions

The student housing sector in Piedmont is on the cusp of transformation beyond 2024. Anticipating shifts in student demographics, there’s an expected increase in international student numbers, diversifying the tenant base and driving demand for flexible accommodation options.

Technological Advancements in Property Management

Technological innovation is set to revolutionise property management. Smart home technologies, digital maintenance requests, and virtual tours will become standard, offering students convenience and safety. These advancements will not only enhance the student living experience but also streamline operations, reducing costs and increasing efficiency for investors.

Evolving Student Living Preferences

Students’ living preferences are evolving towards more communal and sustainable living spaces. There is a growing demand for accommodations that offer shared study areas, social spaces, and green living options. This shift will influence investment strategies, with a focus on developing properties that align with these preferences to attract and retain tenants.

Influencing Investment Strategies and Market Opportunities

These trends suggest a move towards more sophisticated investment strategies that prioritise tenant experience and sustainability. Investors will need to adapt to these changes to capitalise on new market opportunities, focusing on creating value through enhanced student living environments and leveraging technology to meet the demands of the next generation of students.

Why This Matters

Adapting to these predicted changes is essential for investors looking to remain competitive and successful in the student housing market. Ongoing market analysis and a willingness to embrace new trends will be key to navigating the future landscape of student housing in Piedmont, ensuring sustainable growth and profitability in the years to come.

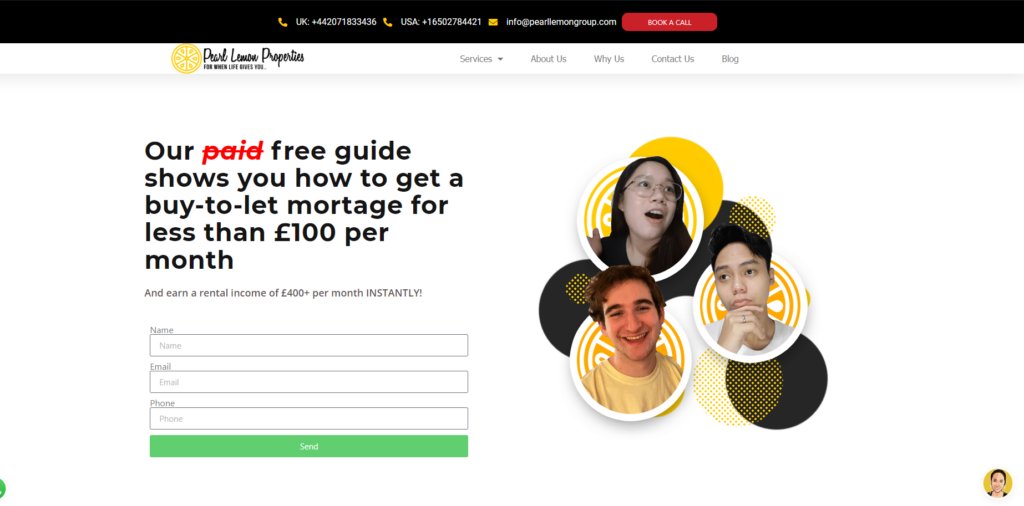

Why Partner with Pearl Lemon Properties

Partnering with Pearl Lemon Properties offers unparalleled benefits for those keen to venture or expand in the Piedmont student apartment market. Our proven track record in delivering exceptional investment returns, coupled with personalised investment strategies tailored to individual investor goals, sets us apart. Leveraging my extensive experience and success in property investment, we provide expert insights and strategic advice to navigate the complexities of the real estate market effectively.

Contact Deepak Shukla at Pearl Lemon Properties

To explore how Pearl Lemon Properties can help achieve your investment objectives in the Piedmont student housing sector, I invite you to get in touch. Let us assist you in unlocking the full potential of your investment portfolio, guiding you towards lucrative opportunities with our expertise and bespoke investment solutions.