Introduction

Turin mansion investments have recently piqued my interest, reflecting a market brimming with growth and potential in 2025. This city, steeped in rich history and culture, is witnessing a burgeoning economy that’s incredibly appealing to investors like myself. My investment philosophy has always centred around identifying opportunities that promise long-term value with a hands-off approach. Turin’s market, with its unique blend of historical charm and economic dynamism, aligns perfectly with this strategy, offering a compelling case for those looking to diversify their portfolio in promising international locales.

Turin’s Mansion Market: An Overview

The Appeal of Turin

Turin, with its vibrant culture, historic charm, and economic opportunities, presents a lucrative avenue for property investments. As of 2025, the city’s real estate market reflects a diverse and dynamic landscape, particularly appealing for those considering mansion investments.

Market Dynamics and Pricing

The residential property market in Turin sees a wide range of asking prices, indicating the variety of investment opportunities available. In February 2025, the average price for residential properties for sale in Turin stood at €1,931 per square metre, a slight increase from the previous year. This upward trend in prices underscores the market’s growth potential and the increasing demand for properties in the region.

Rental properties also show promising trends, with an average asking price of €11.07 per square metre per month in February 2025, marking a significant year-on-year increase. These figures highlight Turin’s growing appeal not just for buyers but also for investors looking to earn rental income.

Neighbourhood Highlights

Turin boasts neighbourhoods with varied characteristics, offering investors the chance to choose properties that align with their investment goals. The Centro area, known for its historic and cultural significance, commands the highest prices, with properties for sale asking up to €3,612 per square metre. In contrast, areas like Aurora, Barriera di Milano, and Rebaudengo offer more affordable options, with prices as low as €1,127 per square metre. This diversity allows investors to strategically select locations based on their budget and investment outlook.

Navigating Challenges

Investing in Turin, especially in mansions or historic properties, comes with its unique set of challenges. From strict regulations on renovating historical buildings to navigating Italian bureaucracy and considering geological risks, investors need to be well-prepared. Understanding these pitfalls and planning accordingly can significantly enhance the investment experience and outcome in Turin’s dynamic market.

Turin’s mansion market in 2025 presents a compelling mix of opportunities and challenges for the discerning investor. With strategic planning, awareness of local market dynamics, and a deep understanding of neighbourhood characteristics, investors can find valuable assets in this historic city, promising both cultural richness and potential financial return.

Challenges and Solutions in Mansion Investing

Navigating Local Regulations

Investing in Turin’s mansion market introduces the challenge of adhering to Italy’s complex property laws, especially regarding historic properties. My experience has shown that understanding these regulations requires specialist knowledge. Therefore, enlisting the support of a local property lawyer who understands the intricacies of Italian property law is crucial. This ensures compliance and smoothens the investment process.

Managing Property from Abroad

Overseeing a mansion from abroad can seem daunting due to the geographical distance and potential language barriers. Leveraging technology for remote management has been a game-changer for me. Tools like property management software enable effective communication with local agents and provide real-time updates on property status. Additionally, establishing a trusted local management team ensures that the property is well-maintained and tenants’ needs are promptly addressed.

Ensuring Investment Security

The Italian property market, while lucrative, carries risks of fluctuating values and unexpected maintenance issues, especially with older mansions. Comprehensive property insurance and conducting detailed due diligence before purchasing can mitigate these risks. Relying on reputable sourcing companies for thorough property vetting and leveraging professional networks for insights into market trends have been invaluable strategies for securing my investments.

Addressing these challenges with informed strategies and leveraging local expertise and technology can make mansion investing in Turin not only viable but also highly rewarding. It underscores the importance of preparation, professional support, and adaptability in navigating the complexities of the real estate market.

Strategic Investment Approaches for Turin Mansions

Buying Off-Plan

Investing in off-plan mansions in Turin offers a unique opportunity to purchase properties at a lower price before they are completed. This strategy allows for significant capital appreciation once the development is finished. My approach has always been to conduct thorough due diligence on the developer’s track record and financial health, ensuring that the project will be completed on time and to the expected standard. This method has often led to below-market prices and high appreciation upon completion.

Renovations for Added Value

Renovating a mansion can significantly increase its value, especially in a historic market like Turin. My strategy involves identifying properties with high potential for value addition through modernisation while preserving their historic charm. Leveraging a network of local architects and builders who understand local regulations and craftsmanship has been key to successfully navigating this process.

Leveraging Short-Term Rentals

Short-term rentals present a lucrative avenue to maximise rental yields, especially in a tourist-friendly city like Turin. By converting part of a mansion into luxury short-term rental suites, I’ve been able to tap into the city’s seasonal tourist market, ensuring a higher occupancy rate and rental income. Investing in professional property management services has been crucial in offering a high-quality guest experience without requiring my constant involvement.

The Role of Sourcing Companies and Networks

Sourcing companies and local networks have been invaluable in identifying investment opportunities, especially those not listed on the open market. These partnerships have provided me with access to exclusive deals and insights into neighbourhood trends, investment risks, and opportunities. Building strong relationships with these entities has often led to early investment opportunities and better negotiation leverage.

Adopting these strategic approaches has allowed me to optimise my investment portfolio in Turin’s mansion market, balancing the need for hands-off investment strategies with the pursuit of high returns.

Case Study: A Successful Turin Mansion Investment

Identifying the Opportunity

The journey began with comprehensive market research, focusing on Turin’s burgeoning neighbourhoods. Leveraging insights from local real estate experts and sourcing companies, I identified a historic mansion in the Crocetta district, known for its quiet, leafy streets and proximity to the city centre. The property, while in need of significant renovation, presented an incredible opportunity due to its undervalued purchase price compared to the potential market value post-renovation.

Decision-Making and Financial Structuring

The decision to invest was grounded in a detailed analysis of the renovation costs, potential appreciation, and rental yields. I structured the investment with a mix of personal equity and a favourable mortgage, securing a low interest rate thanks to the property’s potential and my solid financial standing. The financial plan included a buffer for unforeseen expenses, ensuring the project remained viable even in the face of unexpected challenges.

Management and Outcome

Post-purchase, the renovation project aimed to modernise the mansion while preserving its historical character. I employed a project management team to oversee the renovations, focusing on high-quality craftsmanship and materials. Upon completion, the property was revalued significantly higher than the total investment cost, validating the initial investment thesis. Opting for a mix of long-term rentals and short-term luxury holiday lets maximised rental income, creating a diversified revenue stream.

This case study showcases the successful application of strategic investment principles in the Turin mansion market. From initial research and financial planning to project management and eventual monetisation, the investment underscored the importance of thorough preparation, local expertise, and flexibility in navigating the complexities of real estate investment.

How to Start Your Turin Mansion Investment Journey

Initial Research and Market Analysis

Beginning your investment journey in Turin’s mansion market requires a solid foundation of research. Start by understanding the local property market trends, focusing on areas with high growth potential. Utilise online platforms and local property listings to gauge average prices and demand in various districts. Prioritising neighbourhoods with historical significance and tourist appeal can offer lucrative opportunities for mansion investments.

Evaluating Investment Viability

Assessing the viability of a potential investment is crucial. This involves analysing the property’s condition, potential renovation costs, and expected return on investment. Consider the legal and bureaucratic aspects of purchasing and renovating properties in Italy, particularly those with historical value. Engaging with a financial advisor to review your budget and financing options can provide clarity on your investment capabilities.

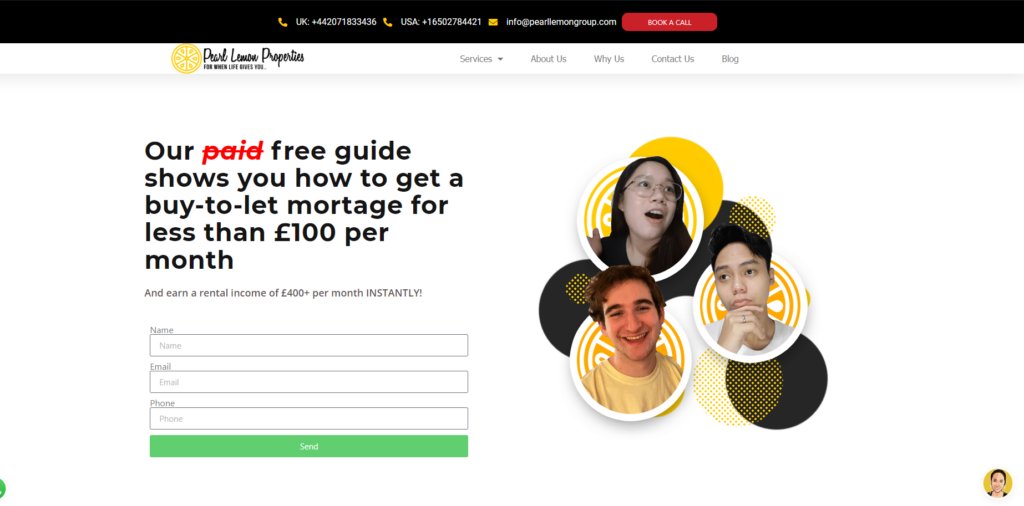

Discover the Potential of Turin with Me at Pearl Lemon Properties

At Pearl Lemon Properties, we specialise in offering bespoke investment strategies tailored to Turin’s unique mansion market. Our team’s extensive market knowledge and personalised service ensure that your investment journey is seamless and rewarding. Whether you’re new to property investment or looking to expand your portfolio, we invite you to explore the exciting opportunities that Turin has to offer. Contact us for a consultation to discuss your investment goals and discover how we can help you achieve them with our expert guidance and support.