Are you ready to take the next step in your property investment career?

Hopefully, you said yes because property investment takes a lot of patience and ambition. If you are just getting into property investment I would recommend joining a community that is interested in the same goals.

The community you join can help provide tips and get you in the investment mindset. They can also help by providing any resources you may need during this process.

Now, this article is aimed at individuals who have experience in property investment but are looking to expand their goals. As you can see, this is the “Ultimate Guide to Property Investment in India”, which will have many challenges and can be a lengthy process.

If you are already living in India then this is a great guide for you. Some steps are for non-residents in India so you can skip those if you are a resident.

For those who are not in India, I would recommend having property investment experience within the area you live. This will help you get familiar with the process before you take on a project in a different country.

Before we get started I would like to discuss the property market in India, some benefits, and risks you should be aware of. This is just a brief overview, as I would highly recommend doing further research on your own.

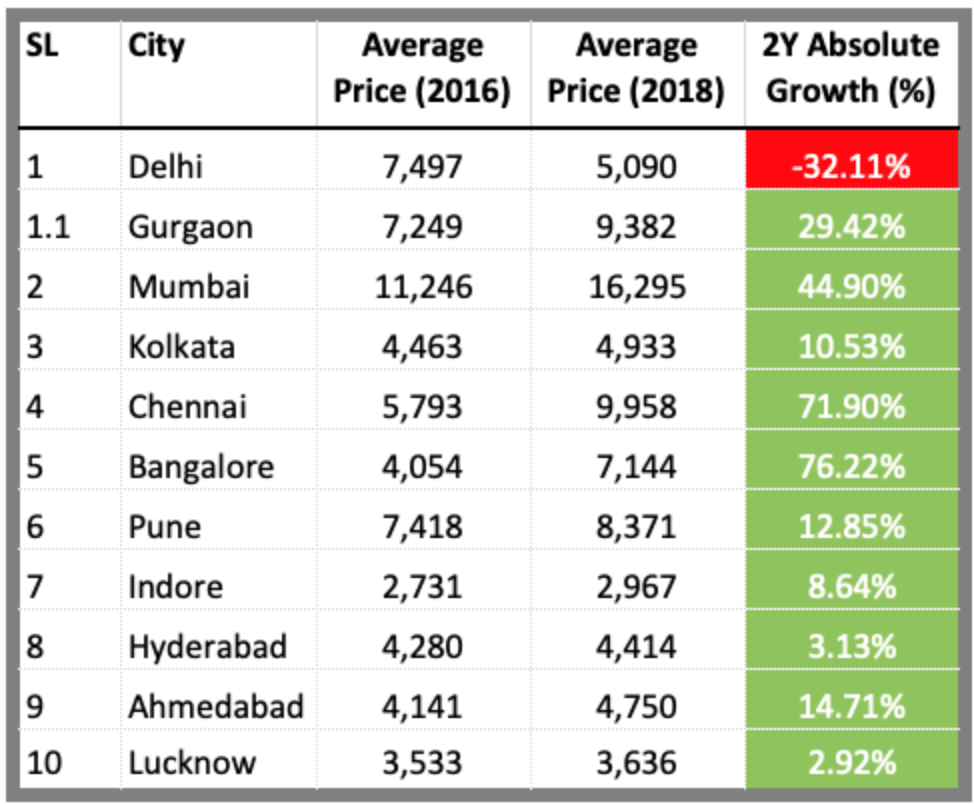

As we can see from the table above, property increases in India due to the growing population and leads to an increasing purchasing power in the Indian Middle class.

To further explain what that means for property investors – property is constantly increasing and prices are going up due to the demand in certain areas. When you purchase a property now and sell it in the future you will end up getting more profit. Which is the whole point of investing in real estate.

According to Get Money Rich,

“The rate at which the rental income grows generally beats inflation in long term”

From this, India makes a perfect place for property investment. Hence, we have this guide for you to benefit from the property market.

Benefits of Investing In India

The previous section was able to touch base on the common quality that all property investors look for. That quality is the value increases over time, which benefits your investments. This generates more money but there are other factors you can benefit from as well.

Positive Demographics

India is a growing country that can support its economic growth. The upcoming generation provides youth for the country and is educated to contribute to their economy. As this generation grows up they will be looking for a place to live. This leads to an increase in property demand.

Strong Economic Growth

Once again the growth in this country is unreal. India is not only growing in population but in developing technology as well. Their developments do not only contribute to their economy but India also contributes globally – as one of the largest sectors in the world.

Concerns

Of course, there will be some concerns to be aware of before making this decision. It is important to research the geopolitical instability in India. This refers to the instability of this region and the frequent terrorist attacks they have witnessed. This hasn’t necessarily thrown off the economy but this creates short-term risks.

The risks may include damage to your property or slowed-down construction. From this, you will face a lack of demand in areas that have witnessed attacks.

Another concern is that most properties are unplanned or built by inexperienced developers. This causes a lot of random development properties that may need more work than expected.

Those are the overall concerns when looking into property investment in India. Again, do more research into these issues to know what exactly you are getting into.

Other than that, you are now ready to jump into our guide!

Guide to Property Investment in India

This guide will cover aspects of money, legal issues, and the building process. You will be making a lot of decisions and the guide is only here to help you through the process. I have included some tips but you will also be using your previous knowledge on property investment.

Financial Planning

This step should come as no surprise that you need to see how much you are willing to invest. Keep in mind that you will have to convert your currency while planning if you are not in India.

I would suggest reading this section first to see the different expenses then you can budget according to your income.

First, if you are a non-resident then you will need an NRE (non-residential external) account. This will allow you to utilize your income from abroad.

Next, it is important to note that the Reserve Bank of India mandates that nonresidential buyers place a minimum of 20% of the property value from the buyers’ sources. The remaining 80% or less can be funded from other sources such as loans or financial programs.

Now let’s go in a bit deeper on the topic of loans.

Preparing for a Loan

The important thing to remember in this section is that your credit score and EMI paying capability will decide your home loan eligibility.

Your credit score is really important because many banks will not provide a loan if your score is below 700. If this is a requirement you do not meet, then you will need to work on your credit score before investing in any property.

Following the credit score will be the EMI paying capability. This stands for “equated monthly instalment” which is a fixed payment amount made by the borrower to the lender. This is expected to be paid by a specific date each month.

The bank will determine your EMI paying capability by looking at the following documents.

- Latest salary slips

- Income Tax Return of last year

- Bank Statements (from the last 6 months)

- Statement of Assets

- Address Proof

- Identity Proof

To help enhance your loan eligibility you can zero out any previous loans (by paying off debt and personal loans.)

Other Expenses

Lastly, you can take a look at what you will be expected to pay.

- Stamp Duty

- Registration

- Brokerage

- Advocate Fees

- Home Loan Processing Fees

- Tax Deducted At Source

- Society Administration Charges

Now that you have taken a look at your income, credit score, and future expenses – you can take all these aspects into consideration and see what property you can afford.

Research

Source: AshtonHawks

Once you have a budget or at least an estimated amount that you are willing to spend – it is time to start looking for properties. To find a property that is worth investing in, will have two characteristics. (1) An attractive project plan, and (2) value for money.

An attractive project plan is looking at the available land around the property. If a property is surrounded by multiple buildings then this is not attractive. It is important to look for property that has an open area that allows for more opportunities to build.

The term “value for money” means that the property should not be expensive. An expensive property not only limits your plans on what to do with the property but it is also not worth the money.

Keeping those characteristics in mind we can now look at other factors during your research.

Investment Parameters

The investment parameters suggest how much each factor should be considered when you are looking at a property. 50% is the Price Factors, 20% is the Vicinity Factor, Specifications is also 20%, and the remaining factors are 10%

Price factor

The price factor is listed at 50% because you cannot make an investment decision solely based on the price. If a property is super cheap but is in a bad location, contains no land, and offers a weak foundation – then you will not make a lot of money from that property. If anything, you will lose money. Hence, the price should be 50% of the reason you choose a property.

Vicinity Factor

Next is the vicinity factor, which is recommended to be 20%. I think this percentage should be higher but that just wouldn’t work out when considering all the other factors. So, for now, it’s 20% but just know that the vicinity of a property plays an important role.

The vicinity factor contains the location, transportation, and any negative attention aspects. The location will determine the value of your property both now and in the future. Try your best to get to know the area you invest in. This will help you learn about any negative attention factors your property may have.

Choose properties that have schools, markets, or any medical centers nearby. This leads to transportation, where the number of roads or any public transportation makes a property more attractive.

Going back to the negative attention a property can have. Includes noisy and struggling areas that have faced hardships. These factors can bring down the attractiveness of a property.

Specifications

As I mentioned before, specifications are also 20% and this applies to the property itself. This is more preferred and can depend on the investor. Here are some specifications to take into consideration.

- Type of House

- New or Used

- Number of bedrooms & bathrooms

- Open floor plan

- Parking

Again the importance of these features is based on the investors’ preferences. The type of house will depend on what you are looking for. Which also leads to new or used property. If you have a preference for how long a house has been in use, then keep that in mind while you are searching. If you don’t want a used house then that is okay. Use these specifications to create preferences for the property you are looking for.

Other Features

Other features to consider should be about 10% of the decision-making process. These included the following:

- Connectivity

- Possible extension

- Land

- Condition

- Security

There can be other features to consider but these will be the main ones. Connectivity refers to cable TV and mobile service. Next – having a property with a possible extension can give you opportunities to add an extra room or even make a room bigger.

As for the land, I mentioned that open land is a good thing but you also want to consider the condition of the land. You can ask yourself if you are looking to add plants or a garden for attractiveness.

Lastly, condition and security refer to the overall condition of the house and area. This includes the safety of the area around the property.

Property Tips

For more assistance, it is recommended to look for property on the outskirts of a city. Within the city, you will find more expensive properties. On the other hand, a property on the outskirts will still provide the attractiveness of the city but is at a cheaper price.

Our last tip is to look for smaller properties. Smaller-sized properties, such as apartments, tend to be in higher demand and liquidation becomes easier.

Now that we have discussed what to look for in a property it’s time to move into the legal preparations.

Legal Preparations

During the process, it is recommended to have the role – “Power of Attorney” (POA). This means that the POA is legally in the position to act in the buyer’s favor. This is a document that allows you, the buyer, to appoint someone to manage your property and financial affairs. The POA will protect the buyer and can secure the investment until you can take over.

Next, it is advisable to have an attorney. This is not the same as the Power of Attorney role which is given to a person who does not have to be a lawyer. An attorney will oversee the paperwork and any transactions. They will run background checks and take a deeper look into the property.

To clarify, the attorney will handle the legal process and oversee everything to be sure that it is safe. The Power of Attorney is just a person that you appoint to make any decisions during the process if you are not able to.

Lastly, it is optional to have a financial advisor to help with your finances. A lot of money is going to different places so this may be helpful!

Property Agent

The next step in building your team is finding a property agent. Your property agent will act as the main messenger for you and the seller. The property agent can help with the following:

- History of the property

- Occupation History

- Current Possession

- Contacting the Seller

Looking at the history of the property will show how long the property has been on the market. This may be smart to see if there is a reason why a property has been on the market for so long.

This leads to the occupation history to see how many times the property has been occupied. If it is a used property, the agent can see how often the property has been lived in. If multiple people have lived in the home and left – there may be a reason why.

Once your property agent has found the information on the first two aspects, it is time to see who currently owns the property. If you received a lot of negative information from looking into the first two aspects then it is time to move on. There is no point in finding the owner if you no longer want the property.

That is why you have the property agent, to help you find more information. So don’t feel discouraged if you keep rejecting properties. This has its benefits in the long run.

After finding the owner it is time to make the decision of contacting them directly. It is highly recommended that the buyer and the team meet the owner. This will help you pick out any shady characters. If you, the buyer, can not make this meeting then you can send your POA.

Placing an Offer

Once you have decided on the property you want to invest in it is time to put in an offer. This section is in the hands of your attorney and property agent. They will take you through the process and the necessary steps that need to be taken. They should clarify when money is being spent and how much.

Feel free to ask questions during this process.

Finding a Builder

Next, you are ready to find a builder! Try having a few contacts on hand prior to this step so that you can give them a call when you are ready. The steps to take with your builder are a lot more complicated than you might think. I have organized the sections below in chronological order of the steps that need to be completed first.

Feel free to ask questions during this process.

Check the Builders Reputation

Many builders are prone to carrying problems such as work delays, bad quality construction, and last-minute changes. To avoid this you and your property agent can take a look at previous works the builder has completed.

Attributes of a good builder can be the following:

- Following the expected time of completion

- Quality of previous work

- Layout & design

- Quality of installed fittings (lightings, plumbing, conditioning, etc.)

Booking Amount

Once you have found the builder of your choice you have to pay a booking amount to the builder. This is considered the first purchase because the payment represents the property being “booked” or secured by the buyer.

First Deposit

Following the booking amount is your first deposit. This will be paid quickly after the booking amount because following that will be the loan disbursement process. Constantly inform your attorney and financial adviser when any payments are made.

At this time the builder may suggest that you go with their pre-approved lender for a loan. You are not obligated to take their advice. If it is something you want to consider then ask your attorney or financial adviser.

Timeline

Next, the timeline of completion needs to be discussed. This will be more in-depth in the next section but you want to determine when the property will be ready. Then, discuss how the builder is expected to respond to delays in the project.

Withdrawal Clause

If you want to exit the deal mid-way, then a withdrawal clause comes into play. The withdrawal clause is to be read and discussed with your builder. It will go over what you will be losing and how previously paid money will be returned.

Warranty

Next, you need to discuss with both the builder and agent what the warranty on the house will be. Typically, newly constructed buildings have a 10-year warranty but double-check this to be sure.

Finish produced

Lastly, discuss with the builder what the finished product will be. Go over any flooring, plumbing, electrical fittings, etc. It might be smart to write this out and keep a copy for yourself to see if everything is delivered in the final product. .

Book Property and Project Launch

Finally, it is time for the project launch. The project launch is when the builder/ developer displays the project plan. The plan will be displayed to the public to gauge the perceptions of the project.

If the response from the public is good during the project launch then the price of the property will go up.

From here, your builder is able to get started and now we wait for the final product! After that, the rest is in your hands.

Conclusion

To review, we have discussed the property market in India and some concerns to be cautious of. We covered the financial planning and research to expect prior to investing. Next, we discovered the people that will help you along the journey. Finally, we discussed the relationship between the buyer and the builder.

Hopefully, you found this helpful, and good luck investing!